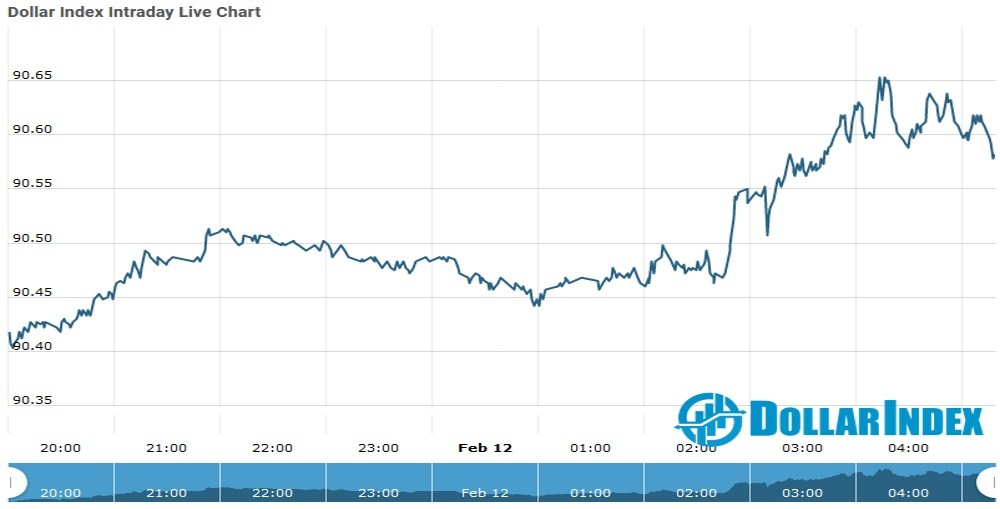

The U.S.Dollar Index is trading at 90.62 up with + 0.23% percent or +0.21 point.The Dow Futures is trading at 31,289.00 with a loss of -0.22% percent or -70.00 point.The S&P 500 Futures is trading at 3,902.38 with a loss of -0.25% percent or -9.62 point.The Nasdaq Futures is trading at 13,706.60 up with -0.16% percent or -22.38 point.

TODAY’S FACTORS AND EVENTS

The dollar dropped to two-week lows on Wednesday in choppy trading, led by losses against sterling and the euro, weighed down by U.S. data showing tepid inflation and a slippage in Treasury yields.

U.S. benchmark 10-year yields were last at 1.136%, down 2 basis points from Monday’s level. The dollar extended losses after data showed U.S. underlying inflation remained benign. Excluding the volatile food and energy components, the CPI was unchanged for a second straight month. Tame inflation data made it more likely the Federal Reserve would keep interest rates ultra-low.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 31,430.70 with a loss of –percent or ?7.10 point. The S&P 500 is trading at 3,916.38 up with + percent or +6.50 point. The Nasdaq Composite is trading at 14,025.77 up with + percent or +53.24 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 2,285.32 up with 0.13% percent or +2.88 point; the S&P 600 Small-Cap Index closed at 1,295.81 up with + percent or +4.88 point; the S&P 400 Mid-Cap Index closed at 2,535.25 up with percent or +16.01 point; the S&P 100 Index closed at 1,796.46 up with + percent or +1.72 point; the Russell 3000 Index closed at 2,375.95 up with +percent or +5.28 point; the Russell 1000 Index closed at 2,226.41 up with +or +5.11 point