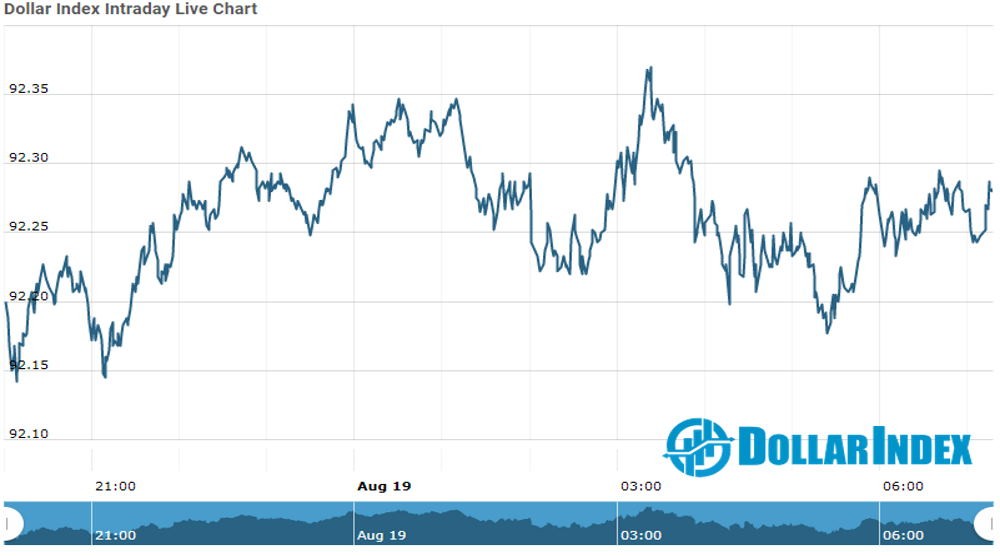

The U.S.Dollar Index is trading at 92.29 with +0.02% percent or +0.01 point.The Dow Futures is trading at 27,773.50 up with +0.20% percent or +56.50 point. The S&P 500 Futures is trading at +56.50 up with +0.18%% percent or +6.12 point.The Nasdaq Futures is trading at 11,426.00 with +0.15% percent or +16.75 point.

TODAY’S FACTORS AND EVENTS

The U.S. dollar index fell to its lowest in more than two years on Tuesday as the ongoing effects of the Federal Reserve’s stimulus programs weakened the greenback broadly for the fifth consecutive day and lifted U.S. stock indexes to record highs.

Although the dollar often functions as a safe-haven investment in moments of crisis, it has fallen since the Federal Reserve’s intervention into financial markets to maintain liquidity in the midst of the coronavirus pandemic. The Fed’s programs have pushed risk assets to all-time highs and reduced demand for safe-havens, even as economic data has painted a bleak picture of the U.S. recovery.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 27,778.07 with a loss of -0.24% percent or -66.84 point. The S&P 500 is trading at 3,389.78 up with +0.23% percent or +7.79 point. The Nasdaq Composite is trading at 11,210.84 up with +0.73% percent or +81.12 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,569.77 with a loss of -0.99% percent or -15.70 point; the S&P 600 Small-Cap Index closed at 907.13 with a loss of –1.30% percent or -11.96 point; the S&P 400 Mid-Cap Index closed at 1,935.98 with a loss of –0.90% percent or -17.58 point; the S&P 100 Index closed at 1,569.45 up with +0.52% percent or +8.17 point; the Russell 3000 Index closed at 1,982.49 up with +0.14% percent or +2.86 point; the Russell 1000 Index closed at 1,882.61 up with +0.21% or +4.02 point.