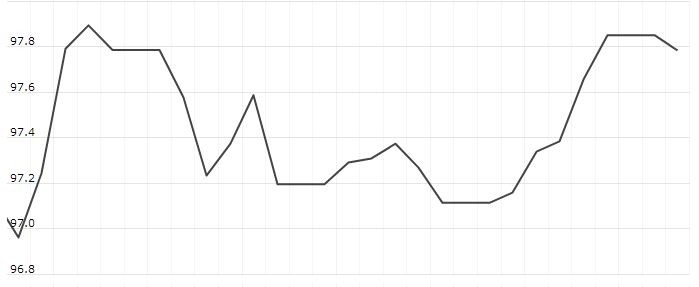

The U.S. Dollar Index is trading at 97.97 with a loss of -0.10% percent or -0.09 point. The Dow Futures is trading at 25,868.50 with a loss of -0.03% percent or -7.50 point. The S&P 500 Futures is trading at 2,863.88 with a loss of -0.07% percent or -2.12 point. The Nasdaq Futures is trading at 7,449.25 with a loss of -0.20% percent or -14.75 point.

TODAY’S FACTORS AND EVENTS

The Japanese yen and the Swiss franc firmed on Wednesday as risk appetite remained weak in the backdrop of festering trade tensions between the United States and China.

While risky assets heaved a sigh of relief overnight after the United States eased trade restrictions on Chinese telecommunications equipment maker Huawei Technologies, the lack of a significant breakthrough has kept investors on edge.

“We are still skeptical over a long-lasting recovery,” said Charalambos Pissouros, a senior markets analyst at JFD group.

“Before we get confident on that front, we would like to see concrete signs that both the US and China are truly willing find common ground.”

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 25,877.33 up with +0.77% percent or +197.43 point. The S&P 500 is trading at 2,864.36 up with +0.85% percent or +24.13 point. The Nasdaq Composite is trading at 7,785.72 up with +1.08% percent or +83.35 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,545.25 up with +1.33% percent or +20.28 point; the S&P 600 Small-Cap Index closed at 939.63 up with +1.23% percent or +11.40 point; the S&P 400 Mid-Cap Index closed at 1,899.74 up with +1.28% percent or +24.05 point; the S&P 100 Index closed at 1,267.75 up with +0.71% percent or +8.90 point; the Russell 3000 Index closed at 1,687.58 up with +0.93% percent or +15.48 point; the Russell 1000 Index closed at 1,586.86 up with +0.90% or +14.08 point.