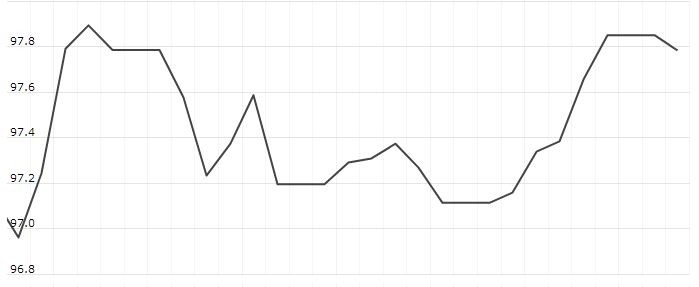

The U.S. Dollar Index is trading at 98.07 up with +0.15 percent or +0.14 point. The Dow Futures is trading at 25,836.50 up with +0.55% percent or +140.50 point. The S&P 500 Futures is trading at 2,861.12 up with +0.60% percent or +17.12 point. The Nasdaq Futures is trading at 7,461.50 up with +0.94% percent or +69.75 point.

TODAY’S FACTORS AND EVENTS

Australia’s top policymaker Philip Lowe said on Tuesday the RBA will consider the case for lower interest rates at its June policy meeting, pushing the Aussie dollar lower half a percent to $0.6873.

“The situation in Asia is difficult – Thailand, Singapore, export decline in Korea – which shows that the trade conflict is hurting even without a further escalation,” said Commerzbank FX strategist Esther Maria Reichelt.

“This is the main cause behind the dollar strength, if anything I was little bit surprised we didn’t see a more pronounced risk movement,” she added.

The dollar hit a 2-1/2 week high against a basket of six major currencies, rising 0.2% to 98.11 in early European trade.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 25,679.90 with a loss of -0.33% percent or -84.10 point. The S&P 500 is trading at 2,840.23 with a loss of -0.67% percent or -19.30 point. The Nasdaq Composite is trading at 7,702.38 with a loss of -1.46% percent or -113.91 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,524.96 with a loss of -0.70% percent or -10.80 point; the S&P 600 Small-Cap Index closed at 928.23 with a loss of -0.68% percent or -6.33 point; the S&P 400 Mid-Cap Index closed at 1,875.69 with a loss of -0.73% percent or -13.71 point; the S&P 100 Index closed at 1,258.85 with a loss of -0.68% percent or -8.56 point; the Russell 3000 Index closed at 1,672.09 with a loss of -0.70% percent or -11.84 point; the Russell 1000 Index closed at 1,572.77 with a loss of -0.70% or -11.13 point.