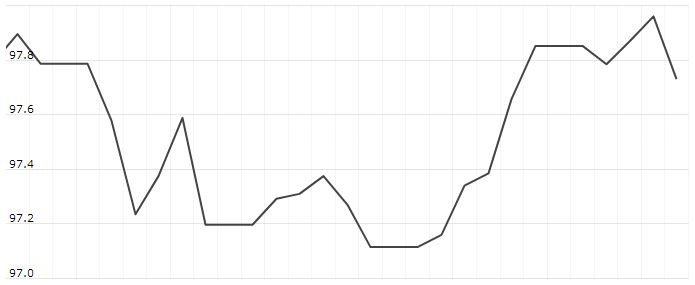

The U.S. Dollar Index is trading at 97.77 with a loss of -0.09% percent or -0.08 point. The Dow Futures is trading at 25,628.00 up with +0.65% percent or +165.00 point. The S&P 500 Futures is trading at 2,837.62 up with +0.64% percent or +18.12 point. The Nasdaq Futures is trading at 7,352.75 up with +0.57% percent or +41.75 point.

TODAY’S FACTORS AND EVENTS

The dollar edged away from two-year highs on Friday after weak U.S. manufacturing activity data sparked worries that the trade conflict with China may hurt the world’s largest economy and affect the currency’s safe-haven status.

Against a basket of six major currencies, the dollar was down 0.2% at 97.686 in early European trade and 0.7% off a two-year high of 98.371 hit the previous session.

The fall followed overnight data showing manufacturing activity hit its lowest level in almost a decade in May, suggesting a sharp slowdown in U.S. economic growth was under way.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 25,490.47 with a loss of -1.11% percent or -286.14 point. The S&P 500 is trading at 2,822.24 with a loss of -1.19% percent or -34.03 point. The Nasdaq Composite is trading at 7,628.28 with a loss of -1.58% percent or -122.56 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,501.38 with a loss of -1.97% percent or -30.25 point; the S&P 600 Small-Cap Index closed at 909.45 with a loss of -2.23% percent or -20.79 point; the S&P 400 Mid-Cap Index closed at 1,853.57 with a loss of -1.68% percent or -31.59 point; the S&P 100 Index closed at 1,249.31 with a loss of -1.17% percent or -14.84 point; the Russell 3000 Index closed at 1,659.90 with a loss of -1.29% percent or -21.65 point; the Russell 1000 Index closed at 1,562.27 with a loss of -1.24% or -19.55 point.