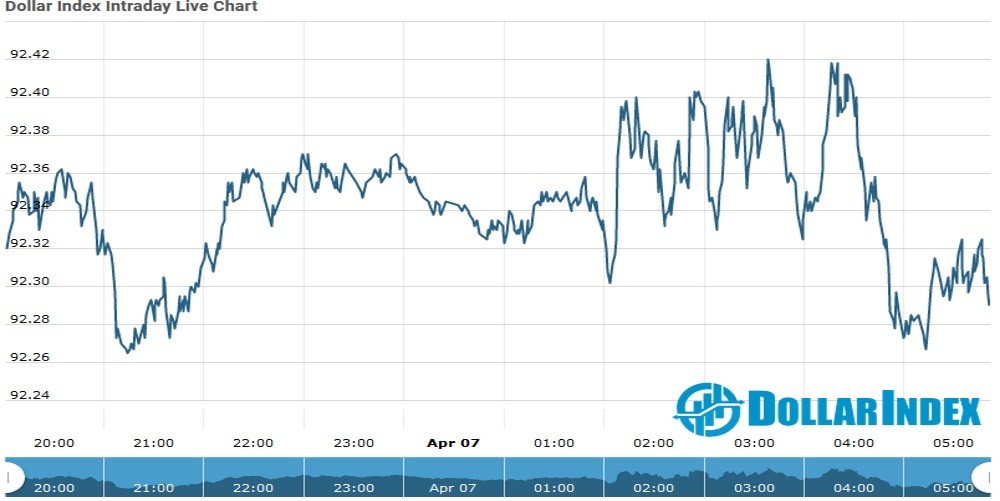

The U.S.Dollar Index is trading at 92.30 with -0.04% percent or -0.03 point.The Dow Futures is trading at 33,315.00 with 0.00% percent or 0.00 point.The S&P 500 Futures is trading at 4,062.88 with a loss of -0.03% percent or -1.12 point.The Nasdaq Futures is trading at 13,568.50 with a loss of -0.01% percent or -1.50 point.

TODAY’S FACTORS AND EVENTS

The dollar softened to a two-week low against a basket of currencies on Wednesday after U.S. bond yields declined as traders rolled back aggressive expectations that the Federal Reserve will tighten its policy earlier than pledged.

The dollar index hit a two-week low of 92.246, slipping further from a five-month high of 93.439 set on March 31, and last stood at 92.343.

“Following the dollar’s strong gains last quarter, some investors appeared to have over-allocation in dollar assets and they probably need to sell dollars for rebalancing,” said Kazushige Kaida, head of FX Sales at State Street Bank’s Tokyo branch

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 33,527.19 up with +percent or +373.98 point. The S&P 500 is trading at 4,077.91 up with + percent or +58.04 point. The Nasdaq Composite is trading at 13,705.59 up with + percent or +225.49 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 2,259.15 with a loss of -0.25% percent or -5.73 point; the S&P 600 Small-Cap Index closed at 1,343.93 with -0.15% percent or -2.08 point; the S&P 400 Mid-Cap Index closed at 2,666.66 up with + percent or +1.68 point; the S&P 100 Index closed at 1,850.10 with a loss of – percent or −2.46 point; the Russell 3000 Index closed at 2,443.18 with a loss of percent or −0.22 point; the Russell 1000 Index closed at 2,296.28 up with + or –0.21 point