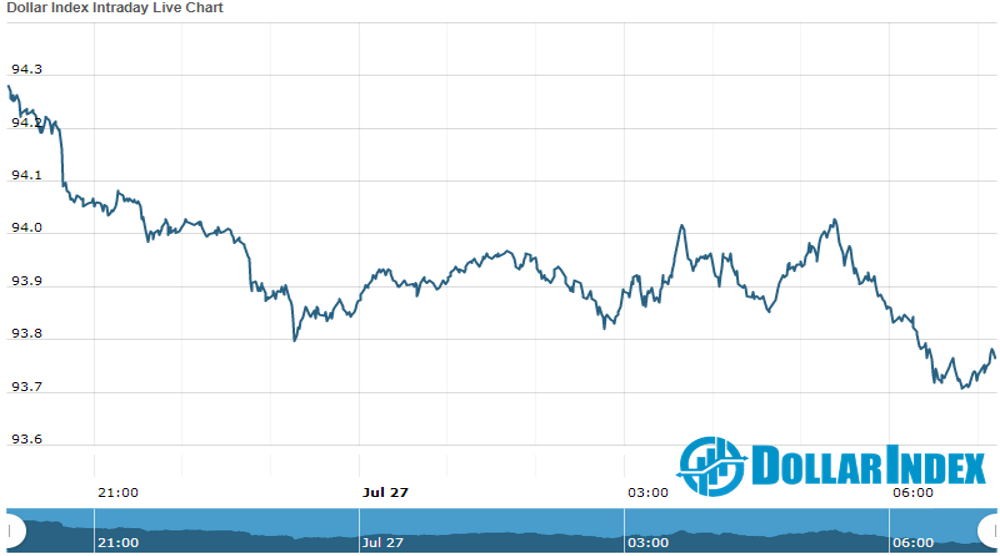

The U.S. Dollar Index is trading at 93.77 with a loss of -0.70% percent or -0.66 point.The Dow Futures is trading at 26,422.00 up with +0.38% percent or +100.00 point. The S&P 500 Futures is trading at 3,219.62 up with +0.49% percent or +15.62 point.The Nasdaq Futures is trading at 10,555.50 with +0.92% percent or +96.50 point.

TODAY’S FACTORS AND EVENTS

The dollar began the week under pressure from all corners as intensifying Sino-U.S. tensions added to worries that the coronavirus resurgence in United States could undermine the recovery in the world’s biggest economy.

In morning trade it fell to a four-month low against the yen and a new 22-month trough on the euro at $1.1699.

The Antipodean currencies also rose a little and against a basket of currencies the dollar was at its lowest since September 2018.

The lack of support for the greenback, even as tit-for-tat consular closures marked the latest escalation in U.S.-China tensions, is a shift for the dollar which has been closely tracking global sentiment through the coronavirus crisis.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 26,469.89 with a loss of -0.68% percent or -182.44 point. The S&P 500 is trading at 3,215.63 with a loss of –0.62% percent or -20.03 point. The Nasdaq Composite is trading at 10,363.18 with a loss of -0.94% percent or -98.24 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,467.55 with a loss of -1.52% percent or -22.65 point; the S&P 600 Small-Cap Index closed at 851.59 with a loss of –1.68% percent or -14.55 point; the S&P 400 Mid-Cap Index closed at 1,849.94 with a loss of -0.79% percent or -14.71 point; the S&P 100 Index closed at 1,474.12 with a loss of –0.65% percent or -9.57 point; the Russell 3000 Index closed at 1,877.04 with a loss of –0.74%percent or -14.08 point; the Russell 1000 Index closed at 1,783.84 with a loss of –0.70% or -12.54 point.