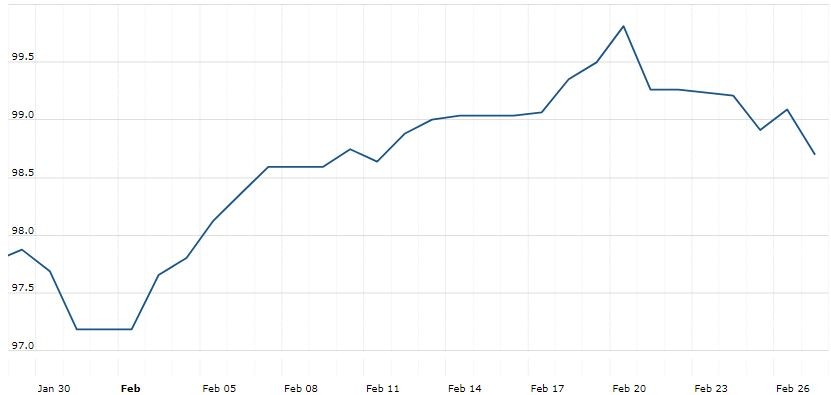

The U.S. Dollar Index is trading at 97.76 with a loss of -0.38% percent or -0.37 point.The Dow Futures is trading at 25,410.00 up with +0.18% percent or +46.00 point. The S&P 500 Futures is trading at 2,941.25 with a loss of –0.33% percent or -9.75 point.The Nasdaq Futures is trading at 8,461.00 up with +0.08% percent or +7.00 point.

TODAY’S FACTORS AND EVENTS

The yen and the euro were on the front foot against the dollar on Monday as traders raised their bets of an interest rate cut by the U.S. Federal Reserve this month to shield the economy from the rapid spread of the coronavirus.

As U.S. shares were routed in recent days, Federal Reserve Chair Jerome Powell said on Friday the central bank will “act as appropriate” to support the economy in the face of risks posed by the coronavirus epidemic.

Investors took his comments as a hint that the Fed will cut interest rates by at least 0.25 percentage point at its next scheduled meeting on March 17-18.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 25,766.64 with a loss of –4.42% percent or –1,190.95 point. The S&P 500 is trading at 2,978.76 with a loss of –4.42% 8percent or –137.63 point. The Nasdaq Composite is trading at 8,566.48 with a loss of –4.61% percent or –414.29 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,497.87 with a loss of -3.54% percent or –54.89point; the S&P 600 Small-Cap Index closed at 899.84 with a loss of –3.76% percent or –35.19 point; the S&P 400 Mid-Cap Index closed at 1,851.81 with a loss of –3.65%percent or −70.16 point; the S&P 100 Index closed at 1,331.58 with a loss of –4.58% percent or –63.87 point; the Russell 3000 Index closed at 1,745.71 with a loss of –4.33% percent or –79.03 point; the Russell 1000 Index closed at 1,649.14 with a loss of –4.38% or –75.62 point