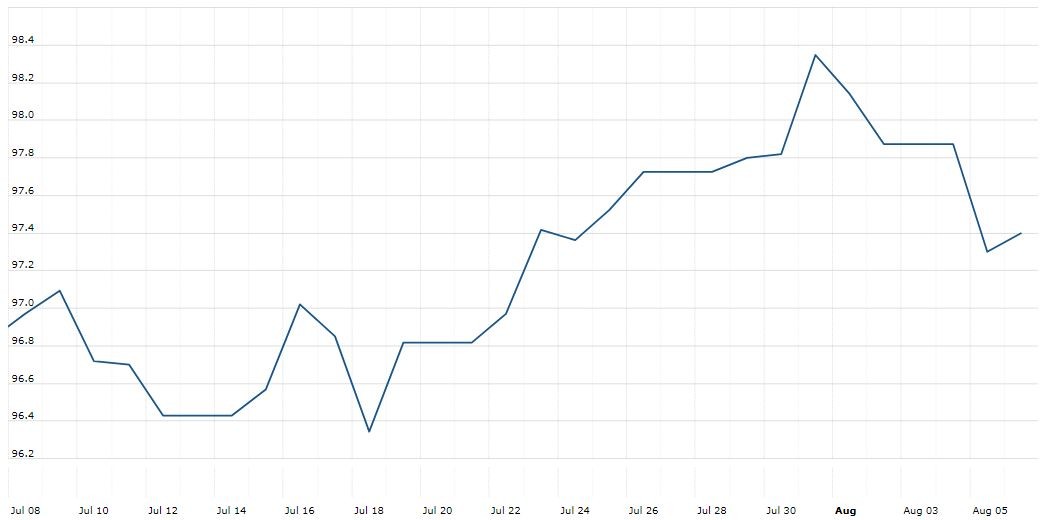

The U.S. Dollar Index is trading at 97.72 up with +0.09% percent or +0.09 point. The Dow Futures is trading at 26,024.00 up with +0.39% percent or +100.00 point. The S&P 500 Futures is trading at 2,886.88 up with +0.38% percent or +10.88 point. The Nasdaq Futures is trading at 7,560.75 up with +0.60% percent or +45.25 point.

TODAY’S FACTORS AND EVENTS

The New Zealand dollar fell 2% on Wednesday after its central bank stunned markets with an aggressive interest rate cut and said negative rates were possible, pushing the Australian dollar lower and triggering a rush into the safety of the Japanese yen.

By 0700 GMT, the Kiwi was on course for its biggest one-day tumble in two years as the currency plunged back to its lowest level since early 2016.

While central banks globally have turned increasingly dovish in recent months as they try to revive growth and fight low inflation rates, the extent of the Reserve Bank of New Zealand’s (RBNZ) move caught markets off guard.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 26,029.52 up with +1.21% percent or +311.78 point. The S&P 500 is trading at 2,881.77 up with +1.30% percent or +37.03 point. The Nasdaq Composite is trading at 7,726.04 with a loss of -3.47% percent or -278.03 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,502.09 up with +0.99% percent or +14.67 point; the S&P 600 Small-Cap Index closed at 921.79 up with +1.11% percent or +10.08 point; the S&P 400 Mid-Cap Index closed at 1,883.50 up with +1.22% percent or +22.67 point; the S&P 100 Index closed at 1,273.35 up with +1.30% percent or +16.36 point; the Russell 3000 Index closed at 1,693.36 up with +1.29% percent or +21.59 point; the Russell 1000 Index closed at 1,595.99 up with +1.31% or +20.69 point.