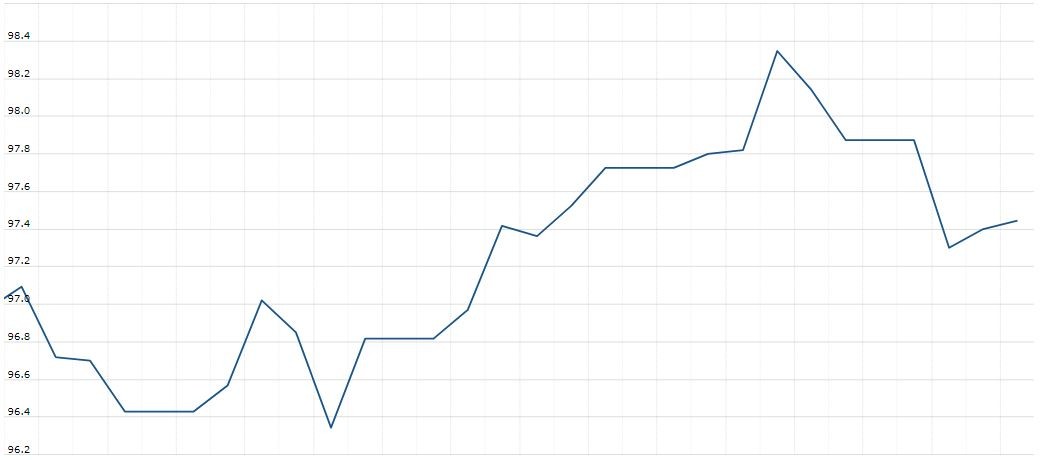

The U.S. Dollar Index is trading at 97.55 with 0.00% percent or +0.00 point. The Dow Futures is trading at 25,975.00 up with +0.13% percent or +35.00 point. The S&P 500 Futures is trading at 2,887.62 up with +0.25% percent or +7.12 point. The Nasdaq Futures is trading at 7,586.88 up with +0.45% percent or +33.63 point.

TODAY’S FACTORS AND EVENTS

The dollar edged lower across the board on Thursday, as risk sentiment stabilized after resilient Chinese trade data and Beijing’s efforts to slow a slide in the value of the renminbi encouraged investors to buy riskier currencies.

Data showed Chinese exports rose 3.3% in July from a year earlier, while analysts had looked for a fall of 2%, and policymakers fixed the daily value of the yuan at a firmer level than many had expected, even though it was beyond the 7 per dollar level for the first time since the global financial crisis.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 26,007.07 with a loss of -0.086% percent or -22.45 point. The S&P 500 is trading at 2,883.98 up with +0.077% percent or +2.21 point. The Nasdaq Composite is trading at 7,862.83 up with +0.38% percent or +29.56 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,500.69 with a loss of 0.093% percent or -1.40 point; the S&P 600 Small-Cap Index closed at 922.68 up with +0.097% percent or +0.89 point; the S&P 400 Mid-Cap Index closed at 1,887.31 up with +0.20% percent or +3.81 point; the S&P 100 Index closed at 1,273.00 with a loss of -0.027% percent or -0.35 point; the Russell 3000 Index closed at 1,695.10 up with +0.10% percent or +1.73 point; the Russell 1000 Index closed at 1,597.84 up with +0.12% or +1.85 point.