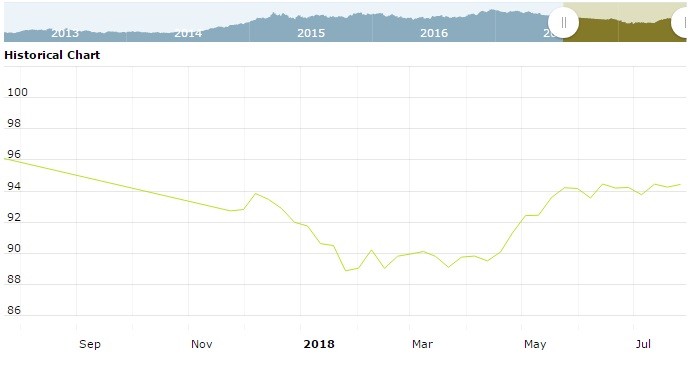

The U.S. Dollar Index is trading at 94.60 with a loss of -0.03% percent or -0.03 point. The Dow Futures is trading at 25,121.00 up with +0.35% percent or +88.00 point. The S&P 500 Futures is trading at 2,817.50 up with +0.20% percent or +5.50 point. The Nasdaq Futures is trading at 7,441.00 up with +0.14% percent or +11.50 point.

TODAY’S FACTORS AND EVENTS

U.S. Treasury yields rose on expectations the Federal Reserve would persist with its rate hikes this year.

The dollar index, a measure of the currency against a basket of six rivals, traded a flinch lower at 94.618 on Tuesday compared to the previous day.

It was firmly off a one-year high of 95.652 touched on Friday.

A jump in benchmark 10-year U.S. Treasury yields to a five-week high had provided support to the dollar in U.S. trade on Monday. The surge in yields came despite criticism from President Donald Trump about the impact of the strength of the greenback and Federal Reserve interest rate rises on the economy.

PREVIOUS DAY ACTIVITY

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,698.41 up with +0.095% percent or +1.61 point; the S&P 600 Small-Cap Index closed at 1,055.76 with a loss of -0.022% percent or -0.23 point; the S&P 400 Mid-Cap Index closed at 1,998.01 with a loss of -0.018% percent or -0.35 point; the S&P 100 Index closed at 1,239.46 up with +0.25% percent or +3.13 point; the Russell 3000 Index closed at 1,670.95 up with +0.15% percent or +2.51 point; the Russell 1000 Index closed at 1,558.22 up with +2.41 percent or -2.03 point;