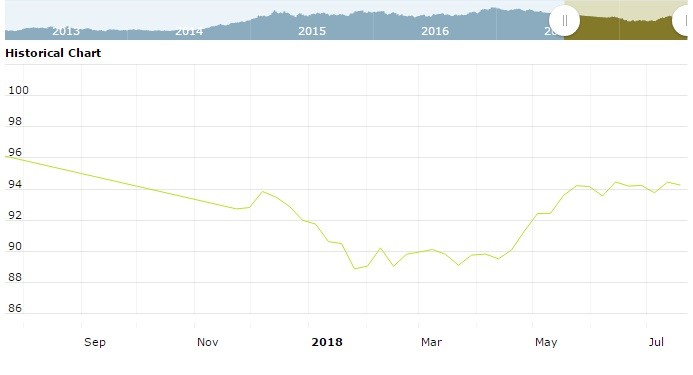

The U.S. Dollar Index is trading at 94.050 with a loss of -0.210% percent or -0.200 point. The Dow Futures is trading at 25,014.00 with a loss of -0.06% percent or -16.00 point. The S&P 500 Futures is trading at 2,798.75 with a loss of -0.07% percent or -2.00 point. The Nasdaq Futures is trading at 7,329.75 with a loss of -0.41% percent or -30.25 point.

TODAY’S FACTORS AND EVENTS

The Japanese yen rallied to near two-week highs against the euro on Monday following reports the central bank was debating moves to scale back its massive monetary stimulus.

Also pushing the yen up were comments by U.S. President Donald Trump on Friday criticizing the greenback’s strength, which in turn hit the Japanese stock markets and triggered a further unwinding of short yen positions.

“The headlines about the Japanese central bank planning to tweak its policy stimulus is triggering this big yen move but unless we see some concrete steps, the yen’s strength may falter,” said Manuel Oliveri, a currency strategist at Credit Agricole in London.

PREVIOUS DAY ACTIVITY

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,696.81 with a loss of -0.26% percent or -4.50 point; the S&P 600 Small-Cap Index closed at 1,055.99 with a loss of -0.28% percent or -2.98 point; the S&P 400 Mid-Cap Index closed at 1,998.36 with a loss of -0.53% percent or -10.69 point; the S&P 100 Index closed at 1,236.33 up with +0.028% percent or +0.35 point; the Russell 3000 Index closed at 1,668.44 with a loss of -0.14% percent or -2.35 point; the Russell 1000 Index closed at 1,555.80 with a loss of -0.13% percent or -2.03 point;