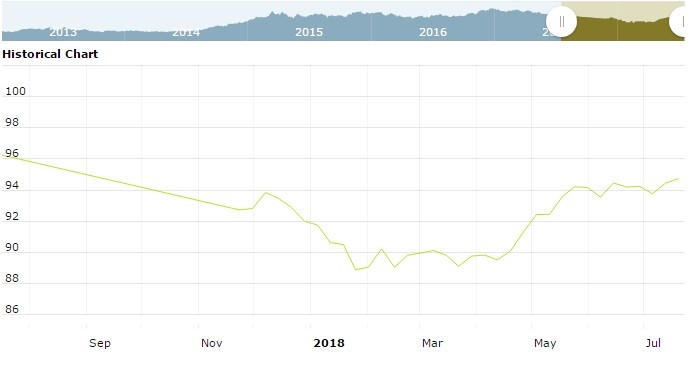

The U.S. Dollar Index is trading at 94.920 with a loss of -0.060% percent or -0.060 point. The Dow Futures is trading at 24,954.00 with a loss of -0.42% percent or -105.00 point. The S&P 500 Futures is trading at 2,798.25 with a loss of -0.25% percent or -7.00 point. The Nasdaq Futures is trading at 7,370.75 up with +0.04% percent or +3.00 point.

TODAY’S FACTORS AND EVENTS

The dollar held below a one-year high on Friday after U.S. President Donald Trump expressed concern about a stronger currency, although a weakening Chinese yuan reduced risk appetite.

The dollar is poised for a second straight week of gains and has gained more than 5 percent in the past three months on expectations the U.S. central bank will keep raising interest rates in the coming months.

But in a CNBC interview on Thursday, Trump said a strong dollar puts the United States at a disadvantage and that the Chinese yuan “was dropping like a rock”.

PREVIOUS DAY ACTIVITY

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,701.31 up with +0.56% percent or +9.44 point; the S&P 600 Small-Cap Index closed at 1,058.97 up with +0.65% percent or +6.84 point; the S&P 400 Mid-Cap Index closed at 2,009.05 up with +0.39% percent or +7.80 point; the S&P 100 Index closed at 1,235.98 with a loss of – 0.53% percent or -6.62 point; the Russell 3000 Index closed at 1,670.79 with a loss of -0.28% percent or -4.66 point; the Russell 1000 Index closed at 1,557.83 with a loss of -0.35% percent or -5.45 point;