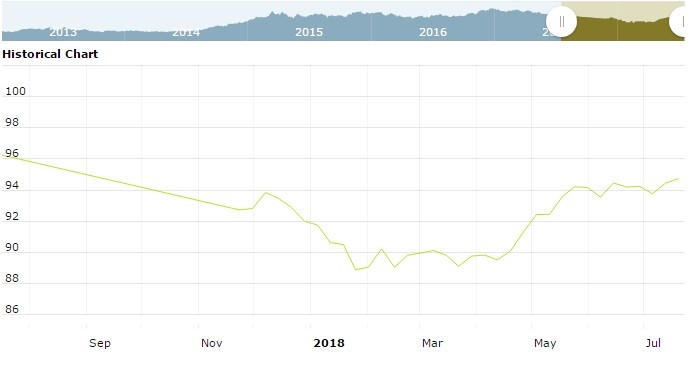

The U.S. Dollar Index is trading at 95.30 up with 0.33% percent or +0.32 point. The Dow Futures is trading at 25,108.00 up with +0.01% percent or +2.00 point. The S&P 500 Futures is trading at 2,811.00 with a loss of -0.01% percent or -0.25 point. The Nasdaq Futures is trading at 7,415.75 with a loss of -0.09% percent or -6.50 point.

TODAY’S FACTORS AND EVENTS

The euro fell and the yen slid to a six-month low on Wednesday as the dollar extended its rally following bullish comments from U.S. Federal Reserve Chairman Jerome Powell about the strength of the U.S. economy.

In his closely watched congressional testimony on Tuesday, Powell said he saw the United States on course for years more of steady growth.

Powell also played down the risks to the U.S. economy of an escalating trade conflict between China and the United States, reinforcing the view of many investors that interest rates will continue rising this year and into next.

The dollar surged across the board, hitting a two-week high against a basket of major currencies.

PREVIOUS DAY ACTIVITY

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,687.26 up with +0.52% percent or +8.72 point; the S&P 600 Small-Cap Index closed at 1,047.63 up with +0.63% percent or +6.53 point; the S&P 400 Mid-Cap Index closed at 1,994.74 up with +0.47% percent or +9.37 point; the S&P 100 Index closed at 1,240.90 up with 0.35% percent or +4.29 point; the Russell 3000 Index closed at 1,671.53 up with 0.43% percent or +7.17 point; the Russell 1000 Index closed at 1,559.66 up with 0.42% percent or +6.58 point;