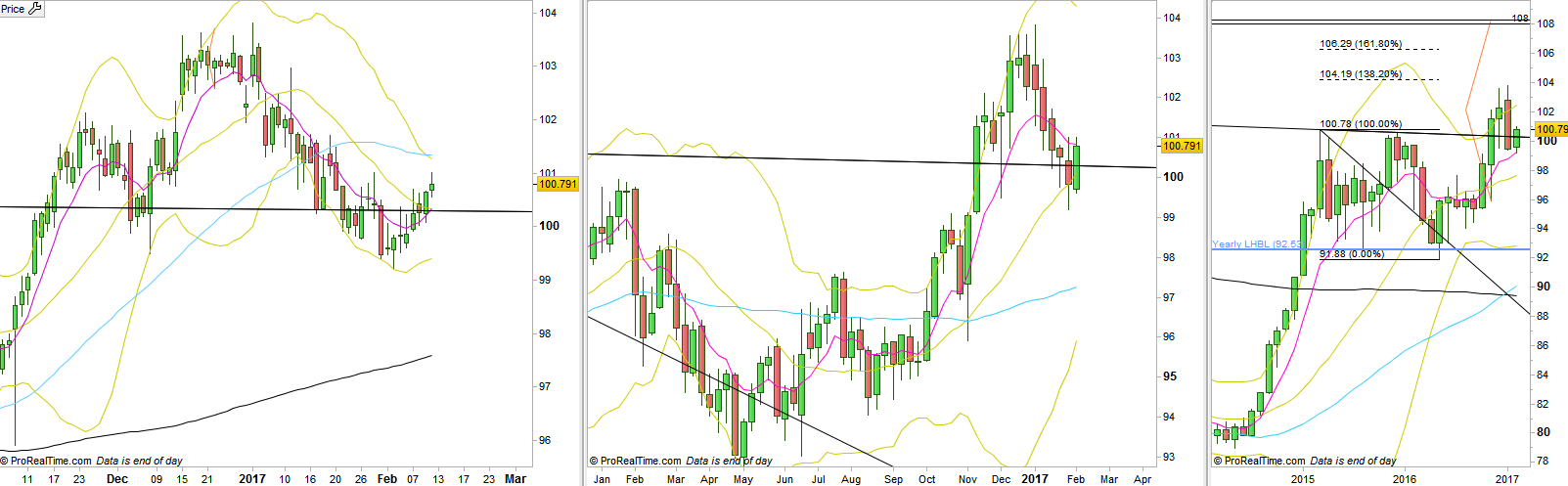

The Dollar Index closed the passing week with a bullish bar but an inside bar. On the Quarterly level, we are testing back (from above) the most important down trend line for the past two years

Taking out the Weekly High might cause the price to rally towards the 101.7-102 area, where the most important resistance level lies, at 101.95.

Taking out the Low of last Friday (while respecting the Low) right at the beginning of the coming week is a clear weakness, and might cause the market to spend more time inside the current Weekly range. In this case, it is very unlikely to see the Weekly Low at 99.195 taken out, but if that is the case then most likely the market is aiming towards 97.5, probably not in one move down, but as a trend with strong bounces up. Besides, there is still an open gap below the Weekly Low that needs to be closed first.

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.