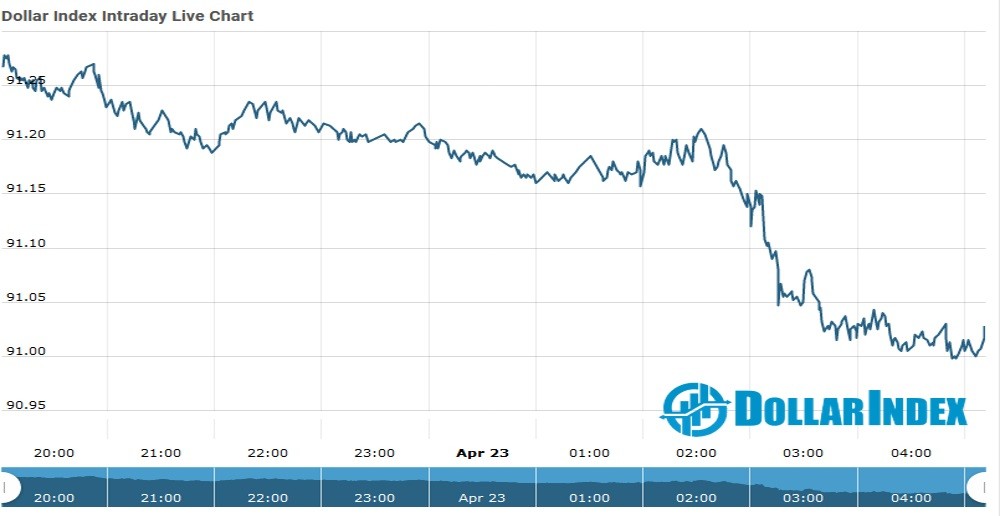

The U.S.Dollar Index is trading at 91.03 with a loss of -0.34% percent or -0.30 point.The Dow Futures is trading at 33,792.00 up with +0.25% percent or +83.00 point.The S&P 500 Futures is trading at 4,138.62 with +0.26% percent or +10.87 point.The Nasdaq Futures is trading at 13,776.00 with +0.19% percent or +25.75 point.

TODAY’S FACTORS AND EVENTS

The dollar was hemmed into a narrow trading range on Friday as traders contemplate the next moves by major central banks ahead of a U.S. Federal Reserve meeting next week.

The euro nursed losses after European Central Bank President Christine Lagarde squashed expectations that policymakers will start to consider a tapering of bond purchases due to an improving economic outlook.

Fed Chairman Jerome Powell is likely to repeat Lagarde’s message that talk of tapering is premature, which would put downward pressure on Treasury yields and cap the dollar’s gains against most currencies.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 34,137.31 up with percent or +316.01 point. The S&P 500 is trading at 4,173.42 up with + percent or +38.48 point. The Nasdaq Composite is trading at 13,950.22 up with percent or +163.95 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 2,232.61 with a loss of percent or −7.01 point; the S&P 600 Small-Cap Index closed at 1,325.8 with a los of -0.48%percent or -6.43 point; the S&P 400 Mid-Cap Index closed at 2,700.37 with a loss of – percent or −11.22 point; the S&P 100 Index closed at 1,878.70 with a loss of – percent or −20.05 point; the Russell 3000 Index closed at 2,476.56 with a loss of –percent or −19.68 point; the Russell 1000 Index closed at 2,331.97 with a loss of – or −19.34 point