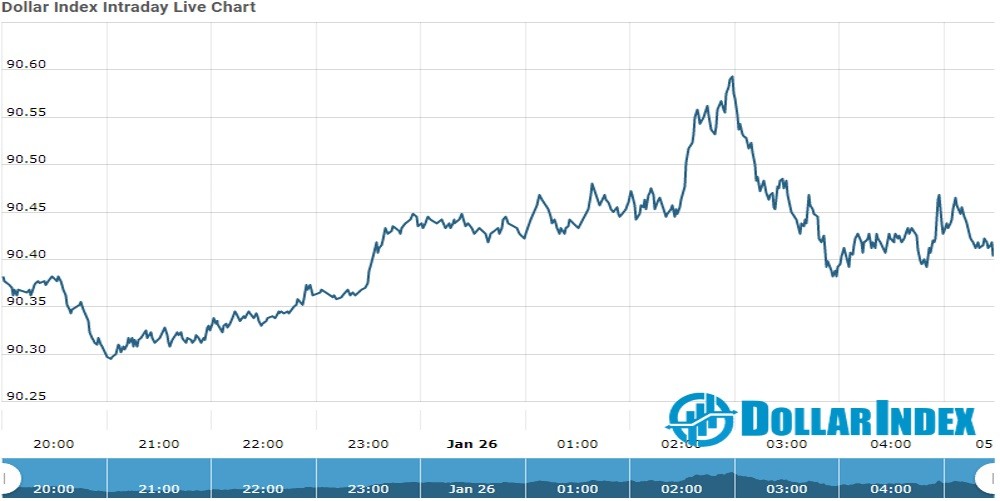

The U.S.Dollar Index is trading at 90.46 up with +0.09% percent or +0.08 point.The Dow Futures is trading at 30,856.00 with a loss of -0.04% percent or -12.00 point. The S&P 500 Futures is trading at 3,842.62 with a loss of –0.15% percent or -5.88 point.The Nasdaq Futures is trading at 13,438.50 with a loss of -0.27% percent or -37.00 point.

TODAY’S FACTORS AND EVENTS

The U.S. dollar steadied on Tuesday as rising coronavirus cases and doubts over the speed and size of U.S. stimulus tempered financial markets’ upbeat mood, while investors were also cautious ahead of the Federal Reserve’s review later in the week.

In overnight trading, bonds rallied, hard-running U.S. equity markets cooled and the cautious move into safer assets lifted the dollar index a little bit to 90.353, which is roughly in the middle of a range it has kept for the past two weeks.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 30,960.00 with a loss of -0.12%percent or -36.98 point. The S&P 500 is trading at 3,855.36 with 0.36% percent or +13.89 point. The Nasdaq Composite is trading at 13,635.99 up with +0.69% percent or +92.93 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 2,163.27 with a loss of -0.25% percent or -5.49 point; the S&P 600 Small-Cap Index closed at 1,232.83 up with +0.092% percent or +1.13 point; the S&P 400 Mid-Cap Index closed at 2,453.80 with a loss of –0.35% percent or -8.73 point; the S&P 100 Index closed at 1,774.64 up with +0.59% percent or +10.43 point; the Russell 3000 Index closed at 2,323.21 up with 0.26%percent or +5.95 point; the Russell 1000 Index closed at 2,182.29 up with +0.29%or +6.41 point