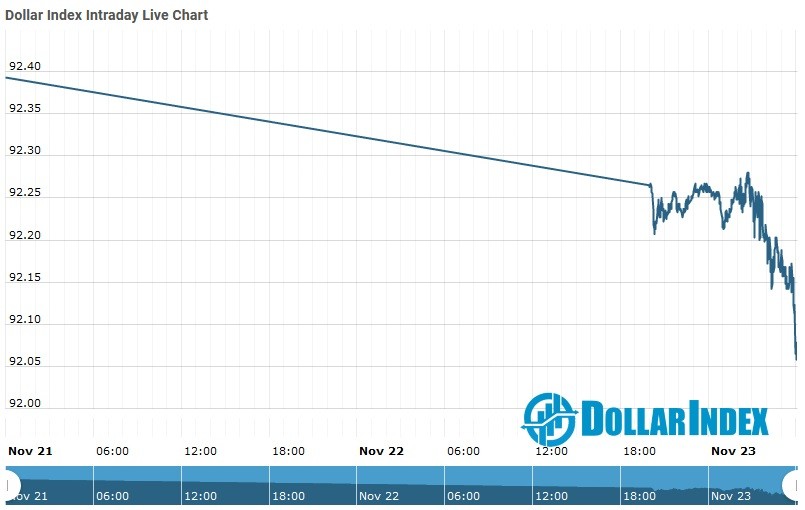

The U.S.Dollar Index is trading at 92.18 with a loss of -0.23% percent or -0.21 point.The Dow Futures is trading at 29,425.00 with +0.73% percent or +213.00 point. The S&P 500 Futures is trading at 3,575.12 up with +0.59% percent or +20.87 point.The Nasdaq Futures is trading at 11,950.50 up with +0.38% percent or +44.75 point.

TODAY’S FACTORS AND EVENTS

The U.S. dollar eased on Monday as the prospect of an early rollout of coronavirus vaccines offset concerns about economic restrictions to control the spread of the virus, favoring risk assets for the moment.

A holiday in Japan kept most majors contained, though the New Zealand dollar stormed to a two-year top of $0.6962 as super-strong retail sales data quashed the risk of further policy easing and left yields attractively high.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 29,263.48 with a loss of –percent or ?219.75 point. The S&P 500 is trading at 3,557.54 with a loss of – percent or ?24.33 point. The Nasdaq Composite is trading at 11,854.97 with a loss of – percent or –49.74 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,785.34 with +0.07% percent or +1.21 point; the S&P 600 Small-Cap Index closed at 1,020.23 with a loss of -0.16% percent or -1.60 point; the S&P 400 Mid-Cap Index closed at 2,147.61 with a loss of – percent or –1.54 point; the S&P 100 Index closed at 1,628.35 with a loss of – percent or −12.16 point; the Russell 3000 Index closed at 2,110.9 with a loss of –percent or −11.46 point; the Russell 1000 Index closed at 1,996.16 with a loss of –or −11.64 point