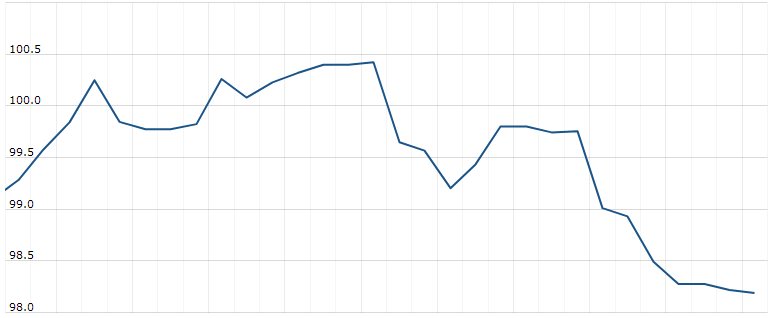

The U.S. Dollar Index is trading at 98.15 with a loss of -0.20% percent or -0.19 point.The Dow Futures is trading at 25,350.00 with a loss of -0.11% percent or -28.00 point.The S&P 500 Futures is trading at 3,033.88 with a loss of -0.18% percent or -5.62 point.The Nasdaq Futures is trading at 9,517.50 with a loss of -0.45% percent or -42.75 point.

TODAY’S FACTORS AND EVENTS

The euro briefly hit its strongest since mid-March on Monday and riskier currencies like the Australian dollar rallied as investors looked to positive signs from China’s post-coronavirus economic recovery and hopes for an easing in Sino-U.S. tensions.

Investors were relieved that U.S. President Donald Trump made no move to impose new tariffs on China during a news conference on Friday where he outlined his response to Beijing’s tightening grip over Hong Kong.

They were also encouraged by the Caixin/Markit Purchasing Managers Index showing a marginal but unexpected improvement in Chinese factory activity last month.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 25,383.11 with a loss of -0.069% percent or -17.53 point. The S&P 500 is trading at 3,044.31 up with +0.48% percent or +14.58 point. The Nasdaq Composite is trading at 9,489.87 with 1.29% percent or +120.88 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,394.04 with a loss of –0.47% percent or -6.64 point; the S&P 600 Small-Cap Index closed at 803.11 with a loss of -1.03% percent or -8.38 point; the S&P 400 Mid-Cap Index closed at 1,763.95 with a loss of –0.52% percent or −9.17 point; the S&P 100 Index closed at 1,389.63 up with +0.49%percent or +6.83 point; the Russell 3000 Index closed at 1,771.37 up with +0.46% percent or +8.15 point; the Russell 1000 Index closed at 1,682.75 up with +0.52% or +8.73 point.