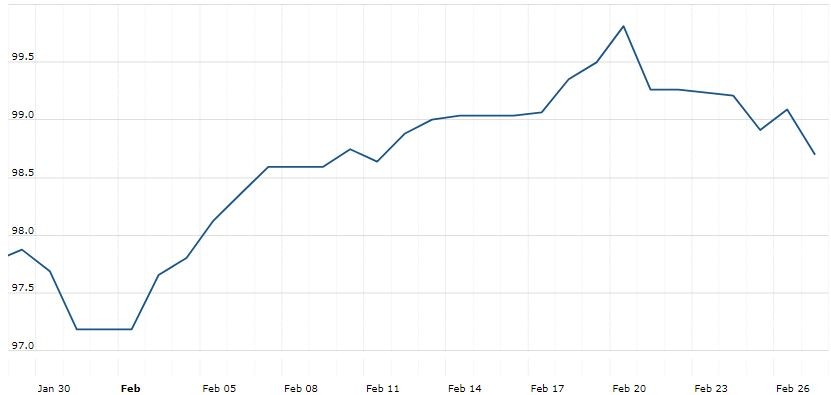

The U.S. Dollar Index is trading at 98.81 with a loss of -0.19% percent or -0.20 point.The Dow Futures is trading at 26,699.00 with a loss of -0.80% percent or -215.00 point. The S&P 500 Futures is trading at 3,087.12 with a loss of -0.74% percent or -23.13 point.The Nasdaq Futures is trading at 8,787.75 with a loss of -0.71% percent or -62.50 point.

TODAY’S FACTORS AND EVENTS

The dollar fell on Thursday as Treasury yields continued to plumb new lows and investors bet the Federal Reserve would cut interest rates to offset the impact of a spreading coronavirus, while the euro bounced half a percent higher.

Money markets are now fully pricing in a 25 basis point cut in the Fed’s rate by April and three by March next year.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 26,957.59 with a loss of –0.46% percent or –123.77 point. The S&P 500 is trading at 3,116.39 with a loss of –0.38% percent or –11.82 point. The Nasdaq Composite is trading at 8,980.77 up with +0.17% percent or +15.16 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,552.76 with a loss of –1.22% percent or -19.14 point; the S&P 600 Small-Cap Index closed at 935.03 with a loss of –1.26% percent or –11.89 point; the S&P 400 Mid-Cap Index closed at 1,921.97 with a loss of –1.54% percent or −29.97 point; the S&P 100 Index closed at 1,395.45 with a loss of –0.19% percent or –2.67 point; the Russell 3000 Index closed at 1,824.74 with a loss of –0.54% percent or –9.85 point; the Russell 1000 Index closed at 1,724.76 with a loss of –0.49% or –8.50 point