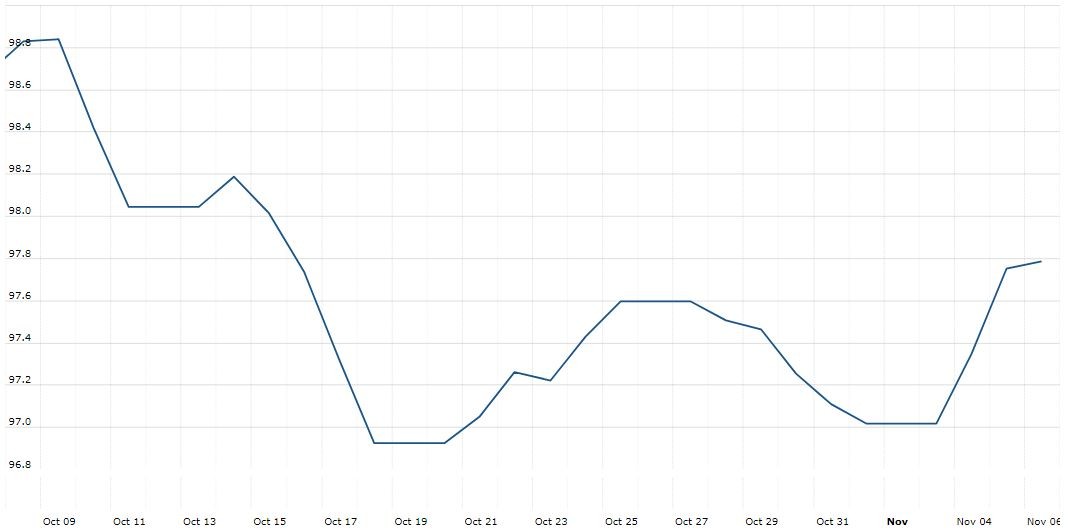

The U.S. Dollar Index is trading at 97.84 with a loss of -0.11% percent or -0.11 point. The Dow Futures is trading at 27,577.50 up with +0.54% percent or +147.50 point. The S&P 500 Futures is trading at 3,088.38 up with +0.42% percent or +12.88 point. The Nasdaq Futures is trading at 8,248.88 up with +0.51% percent or +41.63 point.

TODAY’S FACTORS AND EVENTS

The dollar gained versus the yen on Thursday after comments from a Chinese commerce ministry spokesman about the terms of a possible trade deal prompted investors to dump perceived safe-havens such as the Japanese currency.

The Chinese commerce ministry said that China and the U.S. must simultaneously cancel some existing tariffs on each other’s goods for both sides to reach a “phase one” trade deal.

The proportion of tariffs cancelled must be the same, and how many tariffs should be cancelled can be negotiated, said the spokesman.

The dollar jumped up to near three-month highs versus the yen, retracing its 0.3% losses from earlier in the session, as investors interpreted the comments as positive news, reducing demand for safe-haven currencies.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 27,492.56 with a loss of –0.00026% percent or ?0.070 point. The S&P 500 is trading at 3,076.78 up with +0.070% percent or +2.16 point. The Nasdaq Composite is trading at 8,410.63 with a loss of –0.29% percent or –24.05 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,589.54 with a loss of –0.63% percent or -10.07 point; the S&P 600 Small-Cap Index closed at 984.54 with a loss of –0.57% percent or -5.64 point; the S&P 400 Mid-Cap Index closed at 1,990.35 with a loss of –0.45% percent or −8.98 point; the S&P 100 Index closed at 1,369.79 up with +0.050% percent or +0.68 point; the Russell 3000 Index closed at 1,801.35 with a loss of –0.0086% percent or -0.16 point; the Russell 1000 Index closed at 1,698.41 up with +0.035% or +0.60 point.