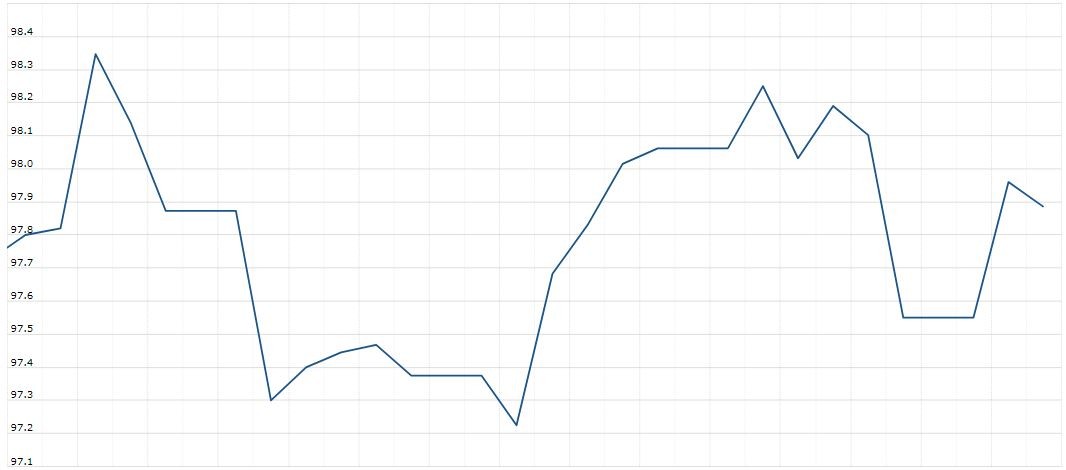

The U.S. Dollar Index is trading at 98.09 up with +0.08 percent or +0.08 point. The Dow Futures is trading at 25,771.00 up with +0.10% percent or +27.00 point. The S&P 500 Futures is trading at 2,870.12 up with +0.16% percent or +4.62 point. The Nasdaq Futures is trading at 7,572.88 up with +0.13% percent or +10.13 point.

TODAY’S FACTORS AND EVENTS

The Japanese yen held onto recent gains on Wednesday as worries about a global economic downturn encouraged investors to buy the safe-haven currency, while broader forex markets were largely quiet as investors watched from the sidelines.

Two-year U.S. government bond yields rose further above 10-year yields

The dollar index, which measures the greenback against a basket of currencies, rose marginally to 98.042.

Elsewhere, weaker risk appetite weighed on the Australian and New Zealanddollars, which tend to perform well when investors buy into riskier assets.

The Aussie has been on the back foot since Reserve Bank of Australia (RBA) Deputy Governor Guy Debelle said on Tuesday that a weakening the currency was supporting the economy and that further falls would be beneficial.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 25,777.90 with a loss of –0.47% percent or –120.93 point. The S&P 500 is trading at 2,869.16 with a loss of –0.32% percent or –9.22 point. The Nasdaq Composite is trading at 7,826.95 with a loss of –0.34% percent or –26.79 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,456.04 with a loss of –1.35% percent or -19.96 point; the S&P 600 Small-Cap Index closed at 895.22 with a loss of –1.18% percent or -10.69 point; the S&P 400 Mid-Cap Index closed at 1,832.63 with a loss of –1.01% percent or -18.76 point; the S&P 100 Index closed at 1,268.06 with a loss of –0.29% percent or –3.73 point; the Russell 3000 Index closed at 1,681.17 with a loss of –0.43% percent or -7.27 point; the Russell 1000 Index closed at 1,587.13 with a loss of –0.37% or -5.84 point.