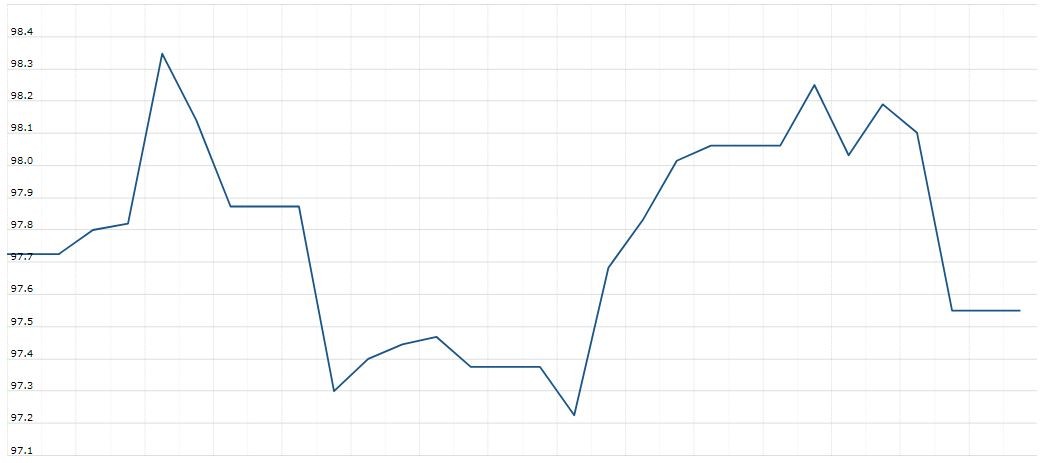

The U.S. Dollar Index is trading at 97.94 up with +0.31% percent or +0.31 point. The Dow Futures is trading at 25,828.00 up with +0.62% percent or +158.00 point. The S&P 500 Futures is trading at 2,869.62 up with +0.49% percent or +14.12 point. The Nasdaq Futures is trading at 7,565.25 up with +0.81% percent or +60.75 point.

TODAY’S FACTORS AND EVENTS

The yen, often bought as a safe haven, briefly rose to the highest against the dollar since a January flash crash. But those gains were erased as Japanese importers sold yen, which remained firmer against other currencies, a sign of waning risk appetite.

“China’s economy is slowing, so the yuan will only fall further unless authorities take steps to stop it,” said Takuya Kanda, general manager of the research department at Gaitame.com Research Institute in Tokyo.

“Some dollar buying from Japanese importers pulled dollar/yen off its lows, but excluding such real demand there’s no reason to buy the dollar. The yen will continue to rise.”

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 25,628.90 with a loss of –2.37% percent or –623.34 point. The S&P 500 is trading at 2,847.11 with a loss of –2.59% percent or –75.84 point. The Nasdaq Composite is trading at 7,751.77 with a loss of –3.00% percent or –239.62 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,459.49 with a loss of –3.09% percent or -46.52 point; the S&P 600 Small-Cap Index closed at 896.50 with a loss of –3.12% percent or -28.85 point; the S&P 400 Mid-Cap Index closed at 1,836.55 with a loss of –2.75% percent or -51.91 point; the S&P 100 Index closed at 1,256.91 with a loss of -2.66% percent or -34.40 point; the Russell 3000 Index closed at 1,670.74 with a loss of –2.60% percent or -44.66 point; the Russell 1000 Index closed at 1,576.36 with a loss of –2.57% or -41.58 point.