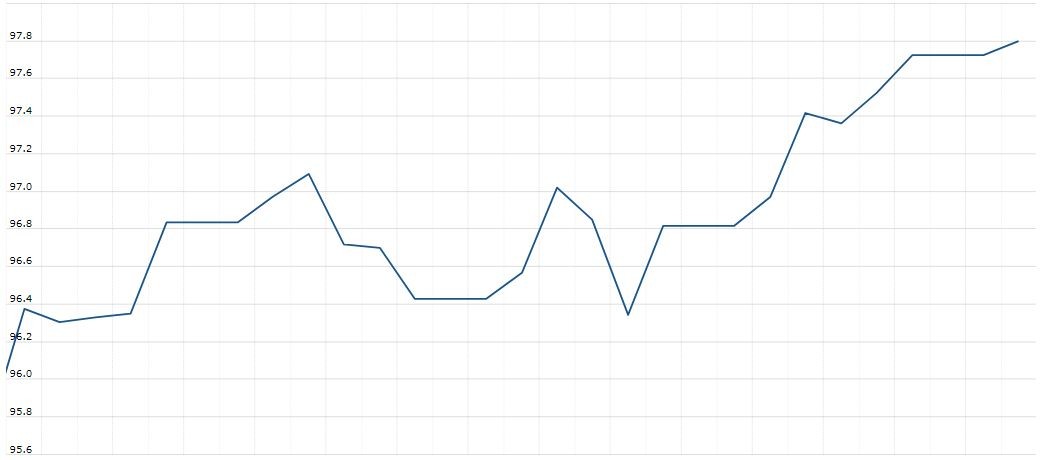

The U.S. Dollar Index is trading at 98.09 up with +0.03% percent or +0.03 point. The Dow Futures is trading at 27,221.50 up with +0.20% percent or +55.50 point. The S&P 500 Futures is trading at 3,016.12 up with +0.13% percent or +3.87 point. The Nasdaq Futures is trading at 7,987.38 up with +0.29% percent or +23.00 point.

TODAY’S FACTORS AND EVENTS

The dollar dipped on Wednesday after two-month highs as robust economic data all but ruled out the chance that the U.S. Fed may deliver a half-point interest rate cut, while the British pound steadied after losing 3% over the past four trading days.

The Federal Reserve is expected at 1800 GMT to announce its first rate cut since 2008 and 78% of traders now price a 25 basis-point cut, with the likelihood of a deeper easing diminishing as data, from second-quarter economic growth to consumer confidence, has been above-forecast.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 27,198.02 with a loss of -0.086% percent or -23.33 point. The S&P 500 is trading at 3,013.18 with a loss of -0.26% percent or -7.79 point. The Nasdaq Composite is trading at 8,273.61 with a loss of -0.24% percent or -19.71 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,585.60 up with +1.06% percent or +16.57 point; the S&P 600 Small-Cap Index closed at 967.70 up with +1.09% percent or +10.43 point; the S&P 400 Mid-Cap Index closed at 1,986.80 up with +0.65% percent or +12.92 point; the S&P 100 Index closed at 1,332.65 with a loss of -0.38% percent or -5.12 point; the Russell 3000 Index closed at 1,773.04 with a loss of -0.13% percent or -2.23 point; the Russell 1000 Index closed at 1,670.13 with a loss of -0.21% or -3.50 point.