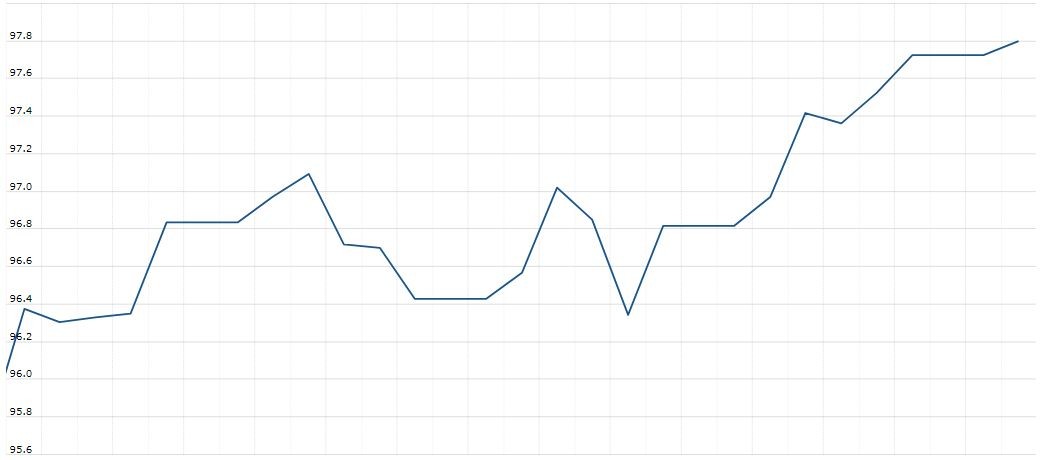

The U.S. Dollar Index is trading at 98.10 up with +0.06% percent or +0.06 point. The Dow Futures is trading at 27,143.00 with a loss of -0.20% percent or -55.00 point. The S&P 500 Futures is trading at 3,013.12 with a loss of -0.30% percent or -9.13 point. The Nasdaq Futures is trading at 7,955.62 with a loss of -0.57% percent or -45.63 point.

TODAY’S FACTORS AND EVENTS

Sterling fell to a new two-year low versus the dollar on Tuesday amid growing speculation that Britain is headed for a messy no-deal Brexit from the European Union.

Sterling has fallen against the dollar for the past four trading days on worries that Britain will exit the EU without agreements on trade and other key issues. There is also a chance that new Prime Minister Johnson will call an early election.

The Fed is expected to cut rates by 25 basis points on Wednesday, and investors are watching for clues on whether the move may be a one-off or the first in a series of several cuts, as many traders are anticipating.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 27,221.35 up with +0.11% percent or +28.90 point. The S&P 500 is trading at 3,020.97 with a loss of -0.16% percent or -4.89 point. The Nasdaq Composite is trading at 8,293.33 with a loss of -0.44% percent or -36.88 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,569.02 with a loss of -0.63% percent or -9.94 point; the S&P 600 Small-Cap Index closed at 957.27 with a loss of -0.54% percent or -5.24 point; the S&P 400 Mid-Cap Index closed at 1,973.88 with a loss of -0.47% percent or -9.26 point; the S&P 100 Index closed at 1,337.77 with a loss of -0.16% percent or -2.10 point; the Russell 3000 Index closed at 1,775.28 with a loss of -0.24% percent or -4.21 point; the Russell 1000 Index closed at 1,673.63 with a loss of -0.21% or -3.50 point.