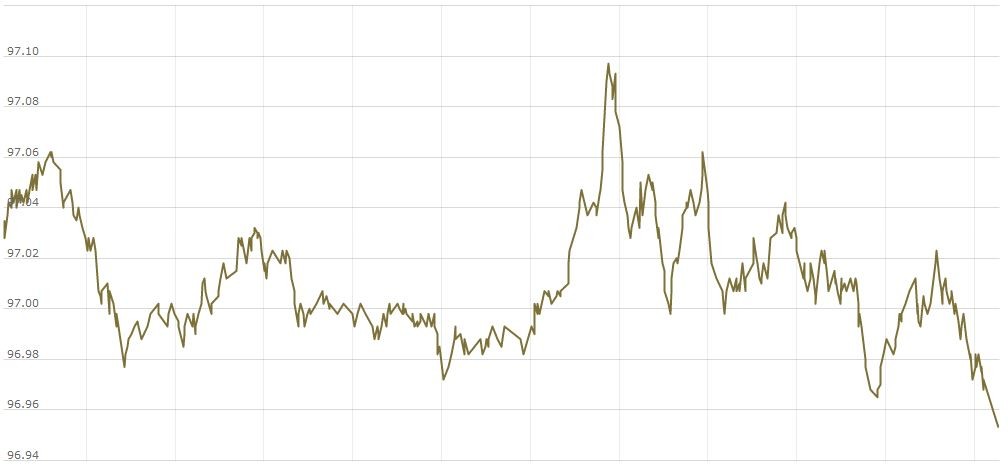

The U.S. Dollar Index is trading at 97.33 with a loss of -0.07% percent or -0.06 point. The Dow Futures is trading at 27,333.50 up with +0.02% percent or +5.50 point. The S&P 500 Futures is trading at 3,008.12 up with +0.02% percent or +0.62 point. The Nasdaq Futures is trading at 7,952.25 up with +0.11% percent or +8.63 point.

TODAY’S FACTORS AND EVENTS

The euro fell to a one-week low against the dollar on Wednesday and towards the lower end of this year’s trading range, weighed down by expectations of monetary policy easing and investors’ preference for the higher-yielding U.S. currency.

Analysts say it is unlikely the euro will recover significantly before a European Central Bank meeting next week at which policymakers might unveil plans for fresh monetary stimulus.

Nearly two interest rate cuts of 10 basis points are priced in by money markets for 2019. A worse-than-expected ZEW survey of German economic sentiment on Tuesday put further pressure on the struggling euro, one of the worst-performing currencies this week along with sterling.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 27,335.63 with a loss of -0.086% percent or 23.53 point. The S&P 500 is trading at 3,004.04 with a loss of -0.34%percent or -10.26 point. The Nasdaq Composite is trading at 8,222.80 with a loss of -0.43% percent or -35.39 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,562.00 up with +0.011% percent or +0.17 point; the S&P 600 Small-Cap Index closed at 948.23 up with +0.13% percent or +1.27 point; the S&P 400 Mid-Cap Index closed at 1,951.83 up with +0.024%percent or +0.47 point; the S&P 100 Index closed at 1,328.17 with a loss of -0.38% percent or -5.07 point; the Russell 3000 Index closed at 1,765.00 with a loss of -0.31% percent or -5.42 point; the Russell 1000 Index closed at 1,663.79 with a loss of -0.33% or -5.49 point.