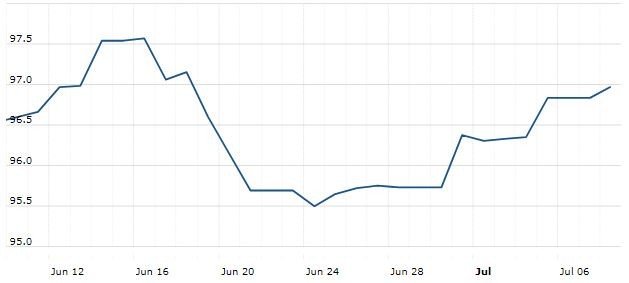

The U.S. Dollar Index is trading at 96.92 with a loss of -0.19% percent or -0.19 point. The Dow Futures is trading at 26,896.00 up with +0.13% percent or +36.00 point. The S&P 500 Futures is trading at 3,001.62 up with +0.16% percent or +4.88 point. The Nasdaq Futures is trading at 7,942.00 with +0.21% percent or +16.50 point.

TODAY’S FACTORS AND EVENTS

The dollar fell to a five-day low on Thursday after Federal Reserve Chair Jerome Powell kept the door open for U.S. interest rate cuts, though investors were wary of selling dollars aggressively until a policy review later this month.

In testimony to Congress, Powell pointed to “broad” global weakness that was clouding the U.S. economic outlook amid uncertainty about the fallout from the trade conflict with China and other nations.

His comments did little to change market expectations — money markets expect one rate cut later this month and a cumulative 68 basis points of cuts until the end of 2019 — but market watchers said Powell’s views will drive the dollar.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 26,860.20 up with +0.29% percent or +76.71 point. The S&P 500 is trading at 2,993.07 up with +0.45% percent or +13.44 point. The Nasdaq Composite is trading at 8,202.53 up with +0.75% percent or +60.80 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,565.05 up with +0.16% percent or +2.46 point; the S&P 600 Small-Cap Index closed at 948.75 up with +0.19% percent or +1.81 point; the S&P 400 Mid-Cap Index closed at 1,945.83 with a loss of -0.071% percent or -1.38 point; the S&P 100 Index closed at 1,324.50 up with +0.59% percent or +7.71 point; the Russell 3000 Index closed at 1,759.13 up with +0.41% percent or +7.13 point; the Russell 1000 Index closed at 1,657.63 up with +0.42% or +7.01 point.