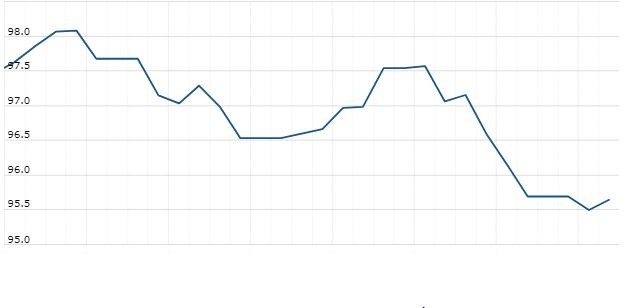

The U.S. Dollar Index is trading at 96.28 up with +0.14% percent or +0.14 point. The Dow Futures is trading at 26,687.50 up with +0.47% percent or +125.50 point. The S&P 500 Futures is trading at 2,937.12 up with +0.52% percent or +15.12 point. The Nasdaq Futures is trading at 7,688.88 up with +0.79% percent or +60.13 point.

TODAY’S FACTORS AND EVENTS

Fed Chairman Jerome Powell stressed the central bank’s independence from U.S. President Donald Trump, who is pushing for rate cuts. St. Louis Fed President James Bullard, considered one of the most dovish U.S. central bankers, surprised some investors by saying a 50-basis-point cut in rates “would be overdone.”

The dollar fell last week after policymakers opened the door to rate cuts in coming months. Some traders thought the Fed might cut rates by as much as 50 basis points next month.

However, the overnight comments tamped down those expectations, pulling the dollar up from three-month lows against a basket of other currencies in the previous session at 95.843. It was up 0.1% at 96.273.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 26,719.13 with a loss of -0.13% percent or -34.04 point. The S&P 500 is trading at 2,950.46 with a loss of -0.13% percent or -3.72 point. The Nasdaq Composite is trading at 8,031.71 with a loss of -0.24% percent or -19.63 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,521.04 with a loss of -0.59% percent or -9.05 point; the S&P 600 Small-Cap Index closed at 922.19 with a loss of -0.47% percent or -4.40 point; the S&P 400 Mid-Cap Index closed at 1,901.33 with a loss of -0.59% percent or -11.32 point; the S&P 100 Index closed at 1,288.61 with a loss of -1.09% percent or -14.21 point; the Russell 3000 Index closed at 1,712.11 with a loss of -0.92% percent or -15.97 point; the Russell 1000 Index closed at 1,613.54 with a loss of -0.95% or -15.45 point.