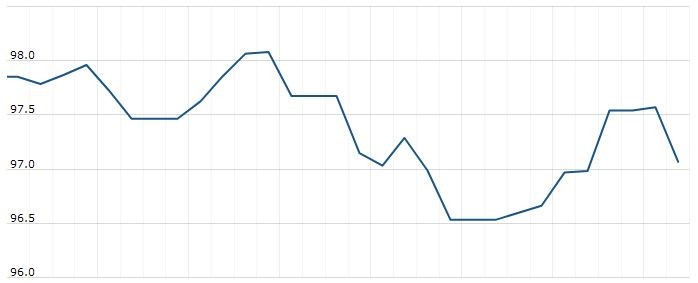

The U.S. Dollar Index is trading at 97.61 up with +0.05% percent or +0.05 point. The Dow Futures is trading at 26,248.00 up with +0.42% percent or +110.00 point. The S&P 500 Futures is trading at 2,910.88 up with +0.51% percent or +14.63 point. The Nasdaq Futures is trading at 7,630.00 up with +0.91% percent or +69.63 point.

TODAY’S FACTORS AND EVENTS

The euro erased earlier gains and fell across the board on Tuesday after European Central Bank chief Mario Draghi said policymakers will provide more stimulus if inflation does not pick up.

At a speech in Sintra, Draghi said the ECB could still cut rates, adjust its guidance, offer mitigating measures to counter the unwanted side effects of negative rates, and also had “considerable headroom” for more asset purchases.

“That is twice in less than two weeks he has warned about the risks to price stability but today we got the clearest hint that a rate cut and/or QE2 could happen,” said Kenneth Broux, a currency strategist at Societe Generale in London.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 26,112.53 up with +0.088% percent or +22.92 point. The S&P 500 is trading at 2,889.67 up with +0.093% percent or +2.69 point. The Nasdaq Composite is trading at 7,845.02 up with +0.62% percent or +48.37 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,532.75 up with +0.67% percent or +10.25 point; the S&P 600 Small-Cap Index closed at 924.01 up with +0.048% percent or +0.44 point; the S&P 400 Mid-Cap Index closed at 1,899.56 with a loss of -0.019% percent or –0.36 point; the S&P 100 Index closed at 1,277.35 up with +0.23% percent or +2.95 point; the Russell 3000 Index closed at 1,699.55 up with +0.15% percent or +2.51 point; the Russell 1000 Index closed at 1,599.94 up with +0.11% or +1.74 point.