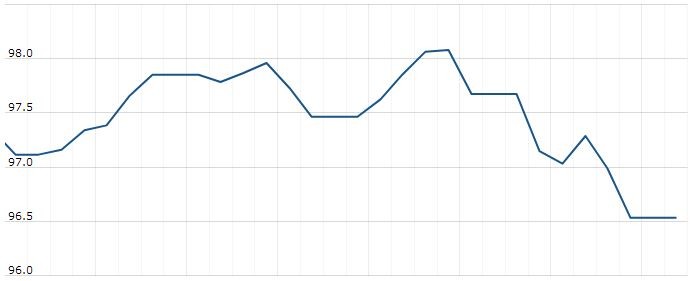

The U.S. Dollar Index is trading at 96.97 with a loss of -0.03% percent or -0.03 point. The Dow Futures is trading at 26,070.50 up with +0.22% percent or +58.50 point. The S&P 500 Futures is trading at 2,887.88 up with +0.24% percent or +6.88 point. The Nasdaq Futures is trading at 7,500.38 up with +0.36% percent or +27.13 point.

TODAY’S FACTORS AND EVENTS

Against the Australian dollar it soared to its highest since a January flash crash. The Aussie, seen as a barometer of global risk sentiment, was also hurt by jobs data taken as a green light for an early interest rate cut.

With growing doubts about any improvement in what U.S. President Trump called “testy” trade relations between Washington and Beijing before the G20 summit, investors sold stocks and looked for safety.

Adding to the unease, protests broke out again in Hong Kong over a planned extradition law with mainland China, while oil prices surged after reports of a tanker on fire in the Gulf of Oman followed earlier sabotage attacks on vessels near the Fujairah emirate.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 26,004.83 with a loss of -0.17% percent or -43.68 point. The S&P 500 is trading at 2,879.84 with a loss of -0.20% percent or -5.88 point. The Nasdaq Composite is trading at 7,792.72 with a loss of -0.38% percent or -29.85 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,519.79 up with +0.045% percent or +0.68 point; the S&P 600 Small-Cap Index closed at 921.83 with a loss of -0.24% percent or -2.21 point; the S&P 400 Mid-Cap Index closed at 1,901.72 with a loss of -0.11% percent or -2.16 point; the S&P 100 Index closed at 1,270.39 with a loss of -0.25% percent or -3.19 point; the Russell 3000 Index closed at 1,693.52 with a loss of -0.18% percent or -3.09 point; the Russell 1000 Index closed at 1,594.84 with a loss of -0.20% or -3.18 point.