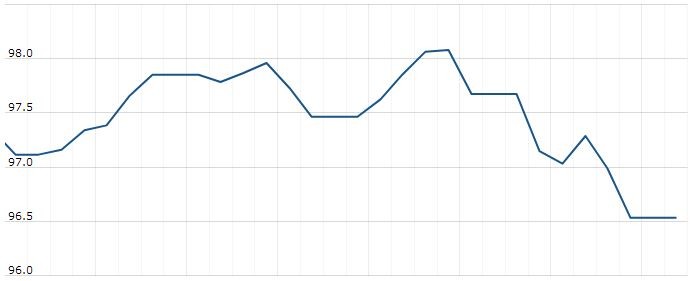

The U.S. Dollar Index is trading at 96.74 up with +0.06% percent or +0.06 point. The Dow Futures is trading at 26,011.00 with a loss of -0.21% percent or -54.00 point. The S&P 500 Futures is trading at 2,881.12 with a loss of -0.20% percent or -5.88 point. The Nasdaq Futures is trading at 7,488.88 with a loss of -0.39% percent or -29.37 point.

TODAY’S FACTORS AND EVENTS

The dollar hovered near an 11-week low against its peers on Wednesday, weighed by expectations the U.S. Federal Reserve could cut interest rates some time in the next few months.

The dollar index versus a basket of six major currencies was effectively flat at 96.707, trading just above the 96.459 level it hit on Monday, its lowest since late March.

The index has been under pressure following a sharp decline in long-term U.S. Treasury yields, which fell to near two-year lows on Friday after a soft U.S. jobs report raised expectations for an interest rate cut by the Fed.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 26,048.51 with a loss of -0.054% percent or -14.17 point. The S&P 500 is trading at 2,885.72 with a loss of -0.035% percent or -1.01 point. The Nasdaq Composite is trading at 7,822.57 with a loss of -0.0077% percent or -0.60 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,519.11 with a loss of -0.29% percent or -4.45 point; the S&P 600 Small-Cap Index closed at 924.04 with a loss of -0.28% percent or -2.56 point; the S&P 400 Mid-Cap Index closed at 1,903.88 up with +0.089% percent or +1.69 point; the S&P 100 Index closed at 1,273.58 up with +0.079% percent or +1.00 point; the Russell 3000 Index closed at 1,696.61 with a loss of -0.074% percent or -1.25 point; the Russell 1000 Index closed at 1,598.02 with a loss of -0.058% or -0.92 point.