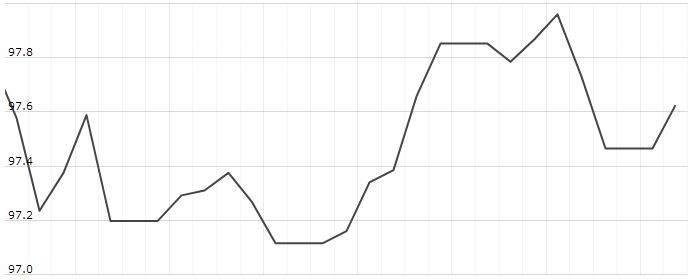

The U.S. Dollar Index is trading at 97.79 up with +0.18% percent or +0.18 point. The Dow Futures is trading at 25,584.00 with a loss of -0.14% percent or -36.00 point. The S&P 500 Futures is trading at 2,824.88 with a loss of -0.24% percent or -6.87 point. The Nasdaq Futures is trading at 7,302.50 with a loss of -0.18% percent or -13.00 point.

TODAY’S FACTORS AND EVENTS

The euro dipped on Tuesday as investors nervous about trade tensions bought into the safe-haven dollar and fretted that political risks in Europe remain high, even though pro-Europe parties won a majority of European parliamentary seats.

Remarks by two euro zone officials that the European Commission was likely to fine Italy on June 5, because its rising debt and structural deficits break European Union rules, also weighed on the single currency.

Pro-Europe parties kept a majority of seats in last week’s European parliamentary elections. Support grew for euroskeptic and right-wing parties, but not as much as investors had feared.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 25,585.69 with a loss of -0.74% percent or -190.92 point. The S&P 500 is trading at 2,826.06 up with +0.14% percent or +3.82 point. The Nasdaq Composite is trading at 7,637.01 up with +0.11% percent or +8.73 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,514.11 up with +0.85% percent or +12.73 point; the S&P 600 Small-Cap Index closed at 917.54 up with +0.89% percent or +8.09 point; the S&P 400 Mid-Cap Index closed at 1,862.83 up with +0.50% percent or +9.26 point; the S&P 100 Index closed at 1,250.67 up with +0.11% percent or +1.36 point; the Russell 3000 Index closed at 1,663.36 up with +0.21% percent or +3.46 point; the Russell 1000 Index closed at 1,564.78 up with +0.16% or +2.51 point.