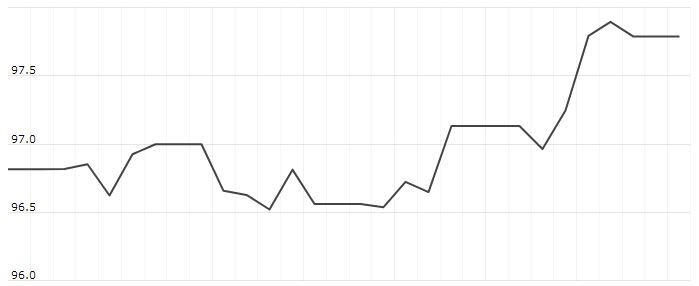

The U.S. Dollar Index is trading at 97.98 with a loss of -0.05% percent or -0.05 point. The Dow Futures is trading at 26,517.00 with 0.00% percent or 0.00% point. The S&P 500 Futures is trading at 2,940.12 with a loss of -0.05% percent or -1.38 point. The Nasdaq Futures is trading at 7,836.75 with a loss of -0.04% percent or -3.50 point.

TODAY’S FACTORS AND EVENTS

A rally in the dollar faltered on Monday with strong U.S. data doing little to lift the currency or convince investors that a slowdown in activity is over.

The greenback traded in a narrow range as Japan kicked off a week of holidays, typically a period of thin liquidity that can prompt spikes in volatility.

A Federal Reserve policy meeting, Brexit negotiations and a raft of global data including on U.S. core inflation and payrolls could each be the trigger for big currency swings this week.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 26,543.33 up with +0.31% percent or +81.25 point. The S&P 500 is trading at 2,939.88 up with +0.47%percent or +13.71 point. The Nasdaq Composite is trading at 8,146.40 up with +0.34% percent or +27.72 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,591.82 up with +1.03% percent or +16.20 point; the S&P 600 Small-Cap Index closed at 972.87 up with +0.91% percent or +8.81 point; the S&P 400 Mid-Cap Index closed at 1,973.92 up with +0.96% percent or +18.78 point; the S&P 100 Index closed at 1,304.15 up with +0.43% percent or +5.61 point; the Russell 3000 Index closed at 1,732.43 up with +0.54% percent or +9.26 point; the Russell 1000 Index closed at 1,628.61 up with +0.50% or +8.10 point.