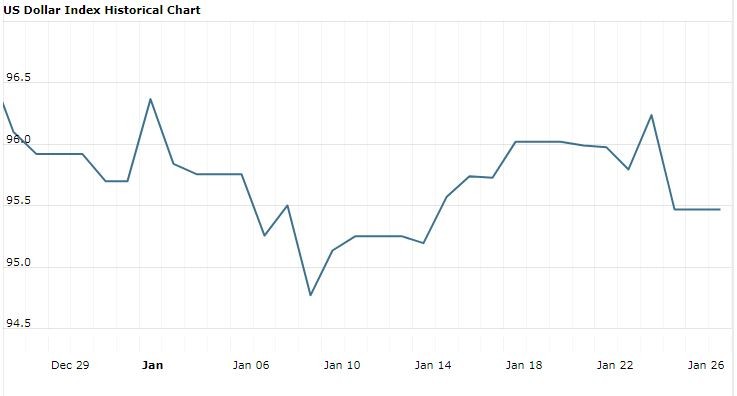

The U.S. Dollar Index is trading at 95.78 with a loss of -0.01% percent or –0.01 point. The Dow Futures is trading at 24,581.50 with a loss of -0.46% percent or -114.50 point. The S&P 500 Futures is trading at 2,650.12 with a loss of -0.50% percent or -13.38 point. The Nasdaq Futures is trading at 6,751.12 with a loss of -0.59% percent or -40.13 point.

TODAY’S FACTORS AND EVENTS

The euro edged down on Monday as investors bought the dollar and prepared for volatile markets ahead of U.S.-China trade talks and a Federal Reserve policy decision.

Investors are focused on Wednesday’s Fed meeting when policymakers are expected to signal a pause in their tightening cycle and to acknowledge growing risks to the U.S. economy.

That will likely weigh on the greenback, which has fallen 1 percent since late December, after enjoying a boost from the Fed’s four rate increases in 2018.

On Monday, however, the dollar was buoyed by safe-haven buying as traders anxiously await news from U.S.-China talks on Tuesday and Wednesday to see if the world’s largest economies can reach a compromise on trade.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 24,737.20 up with +0.75% percent or +183.96 point. The S&P 500 is trading at 2,664.76 up with +0.85% percent or +22.43 point. The Nasdaq Composite is trading at 7,164.86 up with +1.29% percent or +91.40 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,482.85 up with +1.26% percent or +18.45 point; the S&P 600 Small-Cap Index closed at 922.98 up with +1.13% percent or +10.30 point; the S&P 400 Mid-Cap Index closed at 1,818.57 up with +1.07% percent or +19.34 point; the S&P 100 Index closed at 1,176.11 up with +0.74% percent or +8.68 point; the Russell 3000 Index closed at 1,573.31 up with +0.93% percent or +14.43 point; the Russell 1000 Index closed at 1,476.14 up with +0.90% percent or +13.16 point