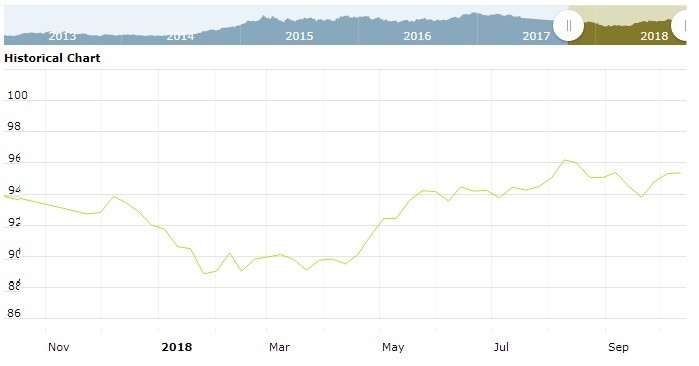

The U.S. Dollar Index is trading at 95.74 up with +0.06% percent or +0.06 point. The Dow Futures is trading at 26,479.00 with a loss of -0.01% percent or -2.00 point. The S&P 500 Futures is trading at 2,887.75 with a loss of -0.02% percent or -0.50 point. The Nasdaq Futures is trading at 7,391.75 with a loss of -0.10% percent or -7.25 point.

TODAY’S FACTORS AND EVENTS

The dollar slipped further from seven-week highs on Wednesday although underlying support for the greenback remained strong amid a confluence of factors, including a strong U.S. economy and a steady path for rate hikes by the Federal Reserve.

While U.S. Treasury yields came off their highs overnight, the propensity for further spikes remained intact as investors bet rising inflation pressures will keep the Fed firmly focused on tighter policy, even as U.S. President Donald Trump took aim at policy makers’ hawkish inclinations.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 26,430.57 with a loss of -0.21% percent or -56.21 point. The S&P 500 is trading at 2,880.34 with a loss of -0.14% percent or -4.09 point. The Nasdaq Composite is trading at 7,738.02 up with +0.027% percent or +2.07 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,621.87 with a loss of -0.47% percent or −7.65 point; the S&P 600 Small-Cap Index closed at 1,015.94 with a loss of- 0.41% percent or -4.19 point; the S&P 400 Mid-Cap Index closed at 1,956.85 with a loss of -0.56% percent or -11.08 point; the S&P 100 Index closed at 1,283.60 with a loss of -0.021% percent or −0.27 point; the Russell 3000 Index closed at 1,697.83 with a loss of -0.19% or -3.31 point; the Russell 1000 Index closed at 1,591.34 with a loss of -0.17% percent or -2.75 point;