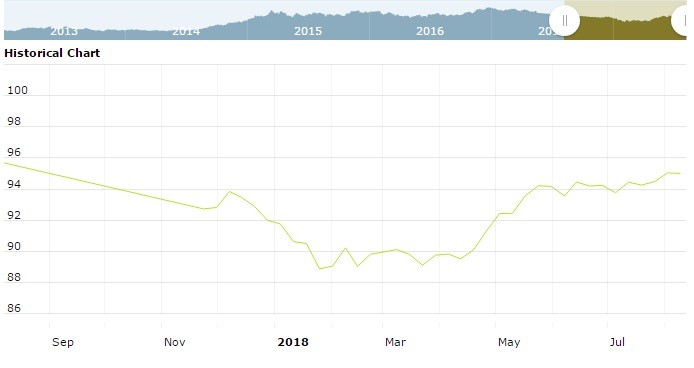

The U.S. Dollar Index is trading at 95.18 with a loss of 0.01% percent or -0.01 point. The Dow Futures is trading at 25,601.00 with +0.00% percent or +1.00 point. The S&P 500 Futures is trading at 2,859.75 with +0.00% percent or +0.00 point. The Nasdaq Futures is trading at 7,475.75 with a loss of -0.02% percent or -1.75 point.

TODAY’S FACTORS AND EVENTS

The euro rose above $1.16 on Wednesday as the dollar’s recent rally ran out of steam, and traders said solid data out of China had calmed investor nerves about recent Sino-U.S. trade tensions, hurting demand for the dollar.

The dollar has weakened since hitting a three-week high on Monday, when the prospect of a full-blown trade war increased demand for the U.S. currency. Traders said the dollar needed a fresh impetus or an escalation in trade tensions to justify a move higher.

PREVIOUS DAY ACTIVITY

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,688.30 up with +0.24% percent or +3.99 point; the S&P 600 Small-Cap Index closed at 1,062.96 up with +0.14% percent or +1.44 point; the S&P 400 Mid-Cap Index closed at 2,015.15 up with +0.28% percent or +5.65 point; the S&P 100 Index closed at 1,266.41 up with +0.30% percent or +3.84 point; the Russell 3000 Index closed at 1,696.80 up with +0.29% percent or +4.95 point; the Russell 1000 Index closed at 1,585.13 up with +0.30% percent or +4.70 point;