US PRE MARKET

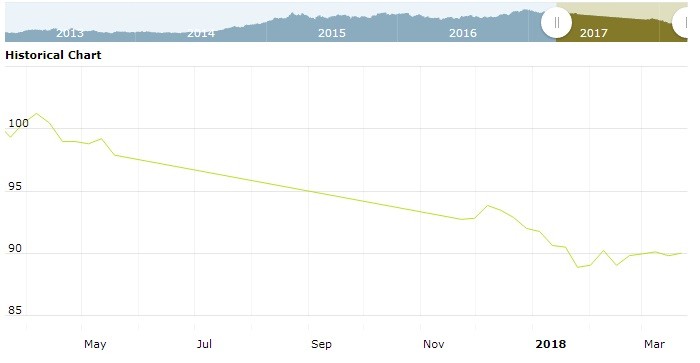

The US Dollar Index are trading at 90.15 for up with +0.25% percent or +0.22 point. The cac 40 index are trading at 5,236.67 with a loss of -0.30% percent or -15.75 point . The DAX Index are trading at 12,297.52 with a loss of -0.08% percent or -9.81 point. The EURO Stoxx 50 Index are trading at 3,404.51 with a loss of -0.22% percent or -7.57 point.

TODAY’S FACTORS AND EVENTS

The dollar pulled back from three-week highs on Wednesday as traders took some profits ahead of the Federal Reserve’s first expected rate rise of 2018 and focused on whether the central bank will indicate three or four hikes for this year.

With the dollar down, the euro and yen were able to recover some losses made on Tuesday, when investors had piled into the greenback.

Elsewhere the Canadian dollar and Mexican peso both made gains after reports that the U.S. administration had dropped a contentious demand related to auto-content, removing a key roadblock to a deal for a new North American Free-Trade Agreement (NAFTA).

PREVIOUS DAY ACTIVITY

U.S. market were higher on Tuesday. For the day the Dow Jones Industrial Average closed at 24,727.27 for up with +0.47% percent or +116.36 point. The S&P 500 closed at 2,716.94 for up with +0.15% percent or +4.02 point. The Nasdaq Composite closed at 7,364.30 for up with +0.27% percent or +20.06 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,570.41 with a loss of -0.01% percent or -0.16 point; the S&P 600 Small-Cap Index closed at 959.43 with a loss of -0.07% percent or -0.71 point; the S&P 400 Mid-Cap Index closed at 1,918.74 for up with +0.06% percent or +1.17 point; the S&P 100 Index closed at 1,192.43 for up with +0.03% percent or +0.32 point; the Russell 3000 Index closed at 1,609.98 for up with +0.14% percent or +2.29 point; the Russell 1000 Index closed at 1,506.62 for up with +0.16% percent or +2.34 point; and the Dow Jones U.S. Select Dividend Index closed at 24,727.27 for up with +0.47% percent or +116.36 point.