US PRE MARKET

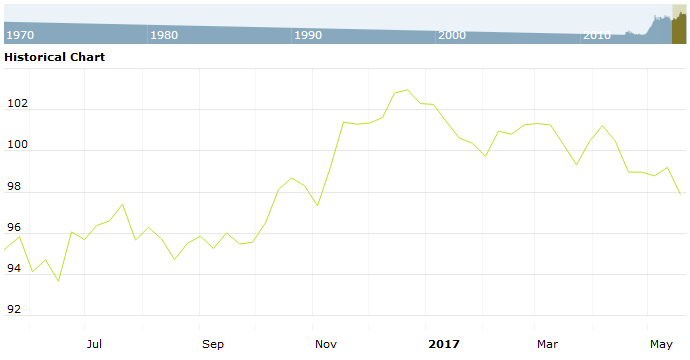

The US Dollar Index are trading at 93.84 with a loss of -0.10% percent or -0.09 point. The cac 40 index are trading at 5,415.90 for up with +0.39% percent or +21.11 point . The DAX Index are trading at 13,027.66 for up with +0.11% percent or +14.47 point. The EURO Stoxx 50 Index are trading at 3,621.33 for up with +0.29% percent or +10.64 point

TODAY’S FACTORS AND EVENTS

The dollar traded near a three-month high against the yen on Wednesday, underpinned by reports that Republican senators were favoring John Taylor to become the next head of the U.S. Federal Reserve.

Australia’s dollar was the biggest mover among major currencies, tumbling as much as 0.8 percent against its U.S. counterpart to a 3-1/2-month low after weak Australian inflation data.

The dollar climbed 0.2 percent against a basket of major currencies, close to its highest levels in three weeks.

Taylor, a Stanford University economist, is seen as someone who could put the Fed on a path of faster interest rate increases compared with current Fed Chair Janet Yellen, whose term expires next February.

PREVIOUS DAY ACTIVITY

U.S. market were higher on Tuesday. For the day the Dow Jones Industrial Average closed at 23,441.76 for up with +0.72% percent or +167.80 point. The S&P 500 closed at 2,569.13 for up with +0.16% percent or +4.15 point. The Nasdaq Composite closed at 6,598.43 for up with +0.18% percent or + 11.60 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,500.42 for up with +0.20% percent or +2.93 point; the S&P 600 Small-Cap Index closed at 911.15 for up with +0.26% percent or +2.38 point; the S&P 400 Mid-Cap Index closed at 1,831.19 for up with +0.34% percent or +6.28 point; the S&P 100 Index closed at 1,131.82 for up with +0.15% percent or +1.67 point; the Russell 3000 Index closed at 1,522.88 for up with +0.16% percent or +2.49 point; the Russell 1000 Index closed at 1,423.93 for up with +0.16% percent or +2.30 point; and the Dow Jones U.S. Select Dividend Index closed at 23,441.76 for up with +0.72% percent or +167.80 point.