US PRE MARKET

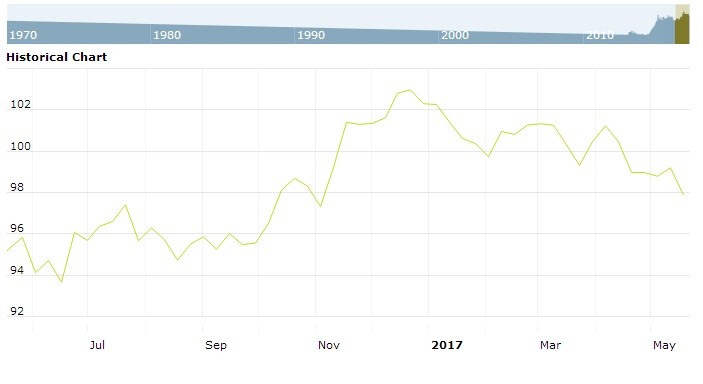

The US Dollar Index are trading at 93.99 with a loss of -0.05% percent or -0.04 point. The cac 40 index are trading at 5,182.88 for up with +1.08% percent or +55.19 point . The DAX Index are trading at 12,277.36 for up with +0.56% percent or +68.41 point. The EURO Stoxx 50 Index are trading at 3,488.80 for up with +1.03% percent or +35.63 point.

TODAY’S FACTORS AND EVENTS

The dollar languished near a 13-month low against a basket of currencies on Tuesday, with traders skeptical that this week’s U.S. Federal Reserve meeting would do much to alter the greenback’s recent weak trend.

The Fed is widely expected to keep interest rates unchanged at its two-day meeting that ends on Wednesday. The focus will be on any hints on whether it may raise rates again this year, and when it will begin paring its bond holdings.

Given the recent weakness in U.S. inflation data, the market is guessing that the Fed’s tone will be dovish and this seems to be weighing on the dollar, said Stephen Innes, head of trading in Asia-Pacific for OANDA in Singapore.

U.S. market indexes were lower on Monday. For the day the Dow Jones Industrial Average closed at 21,513.17 with a loss of –0.31% percent or –66.90 point. The S&P 500 closed at 2,469.91 with a loss of – 0.11% percent or –2.63 point. The Nasdaq Composite closed at 6,410.81 for up with +0.36% percent or 23.05 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,438.05 for up with +0.15% percent or +2.22 point; the S&P 600 Small-Cap Index closed at 868.33 for up with +0.01% percent or +0.08 point; the S&P 400 Mid-Cap Index closed at 1,776.80 for up with +0.16% percent or +2.88 point; the S&P 100 Index closed at 1,086.82 with a loss of-0.08% percent or –0.92 point; the Russell 3000 Index closed at 1,463.99 with a loss of –0.05% percent or –0.70point; the Russell 1000 Index closed at 1,369.24 with a loss of-0.06% percent or –0.89 point; and the Dow Jones U.S. Select Dividend Index closed at 21,513.17 with a loss of –0.31% percent or –66.90 point.