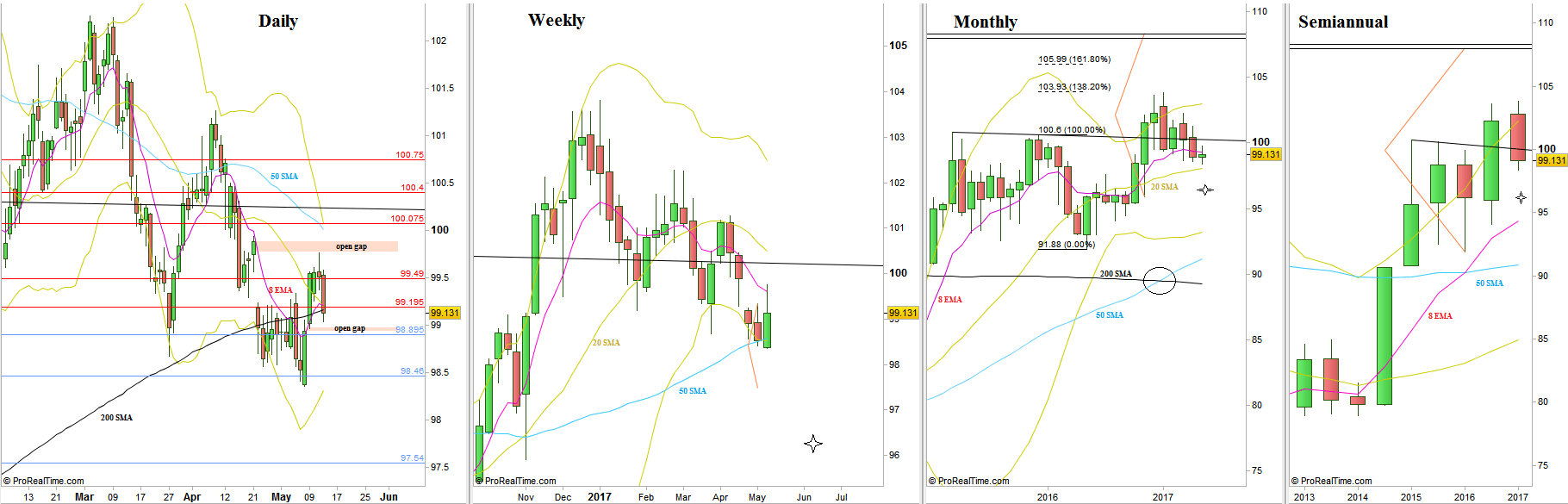

The Dollar Index was very misleading over the passing week, mainly because of the gap down it opened with, and the strong thrust up that on the Daily timeframe created a Megaphone pattern eventually.

In the previous review I mentioned that taking out the Weekly Low is a bearish signal. In case the market opens with a gap down as it did and within the same bar continues to take out the last Daily High (in this case the High of the previous Friday), any bearish position based on the Weekly Idea should have been closed at that moment. It was a clear sign of strength advising not to be bearish on the Weekly scale.

Notice that the open gap above (99.34-99.88) has not been closed completely while the market has reversed down on the Daily, a clear sign of weakness. There is a small open gap below (98.936-98.96) that probably won’t make things easy for the coming week either, and another attempt to close the open gap from above can emerge, or testing of the 99.5-99.7 area.

The general sentiment on the midterm is still bearish, with target at the 96.2 area level, and the passing week looks currently as a big shakeout (that may not be over yet). The current price action indicates that we are going to spend more time at this megaphone area and the current Monthly bar of May can close eventually as a small range bar compared to other Monthly bars lately. A rapid momentum move down to reach 96.2 is much less expected in the current circumstances.

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.