Throughout the passing week, the Dollar Index has been traded in the upper side of the Weekly swing range.

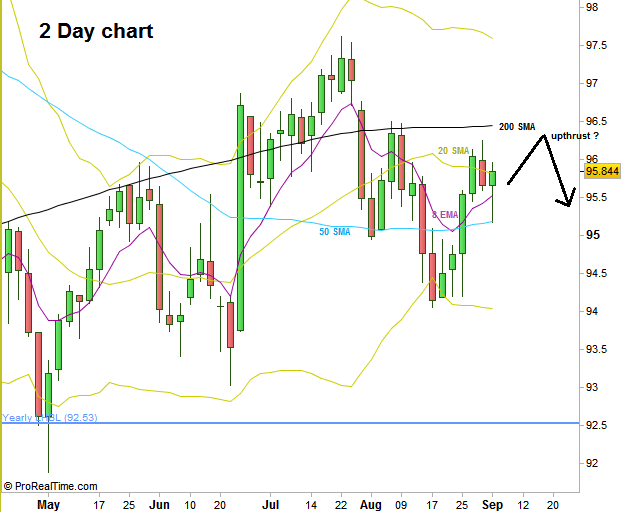

The signs of strength seen as closing an open gap mentioned last review 96.075-96.132, closing the Weekly bar above the Weekly 8 EMA and the Monthly bar of August closing slightly above the 8 EMA – were mixed with signs of weakness as the Weekly bar didn’t manage to touch (not to mention closing above) the Weekly 50 SMA, and the Daily bar of last Friday that although turned into bullish bar by its last trading hours, didn’t manage to close above the Daily 50 SMA.

The High of 96.5 mentioned couple of times in the previous reviews has turned into the High of the month of August, and is currently a clear stop loss level for bearish ideas. Taking out this level doesn’t mean that the Dollar Index is necessarily mid term bullish, but most likely prepares itself to stay in the upper levels of the Quarterly swing range (levels 96-100) for the rest of the current year. Of course, there is always the possibility of a false thrust up the market does sometimes for a shakeout. However, in such cases we need to see a clear price action that confirms the shake out thing later on before being mid term bearish again.

A good bearish signal might come by making an upthrust above the Daily swing, i.e. by taking out the Weekly swing High at 96.25, while still respecting the above mentioned 96.5 High, turning eventually into a false thrust up. A LL below such a daily bar might start an expected bearish wave to take out the Low of last May, at 91.88, on the way down (many chances in this case for the 87 level to be the target).

This week, I choose to bring the 2 Day chart, as IMHO it shows the current price action behavior more clearly. The last bar is still in the making, having one more trading day before its close. Pay attention that currently the last bar looks bullish, above main moving averages around. Starting the coming week with a weak day, might cause the current 2 Day bar to show that weakness, and a different picture eventually.

Dollar Index, 2 Day chart, i.e. each bar is 2 trading days, last bar is not closed yet (at the courtesy of prorealtime.com)

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.