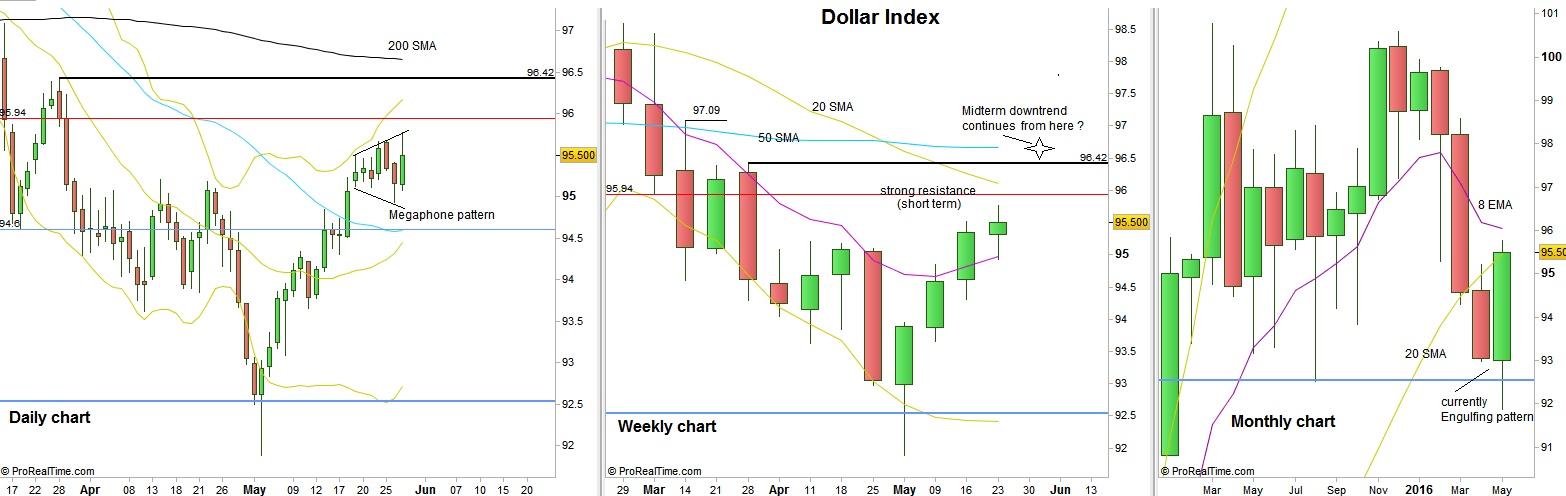

Since the last bottom made at May 3rd, the Dollar index has made a remarkable recovery, heading towards the mid range at 96.5 approximately.

However, at this point, it should still be regarded as a correction in a midterm down trend.

We’ve passed the main barrier in that move, the most important Last High Before Low in this area, at 95.21, and currently the market is correcting in a sideway action, combined of a Megaphone pattern (each High is followed by higher High and each Low is followed by a lower Low). Usually, such pattern brings eventually a reversal, in this case – down, so that the correction is going to turn into a correction in price, not only correction in time (conducted in sideways action), but the amplitude needed to reach the next high has already been achieved, so we might face more of a sideways action (maybe with a false weekly thrust down), or continuing the Weekly current move higher towards the High at 96.42 without a correction in price.

A very important issue is to look at the Monthly bar closing this week. Currently (by the end of the passing week), the market is forming an Engulfing pattern on the Monthly timeframe, a pattern that when followed by a confirmation thrust on the next bar, is very strong and reliable for reversals (a reversal up in this case). But, we should look not only at the pattern, but mainly at the context of the price action combining it. In this case it is the testing of the Monthly 20 SMA from below, and whether closing below or above the fast 8 EMA that usually manifests the short term sentiment.

Closing the monthly bar below/at the Monthly 20 SMA (and below the Monthly 8 EMA as well) shows weakness. Closing above the monthly 8 EMA indicates strength, whereas closing between the two moving averages, like where it is now by the end of the passing week, might bring more consolidation in this area delaying the “decision” for the month of June. In case of a weakness (closing below the Monthly 20 SMA and 8 EMA), I wouldn’t be surprised to see at June a false thrust up that the takes out the next high at 96.42, maybe go higher a little bit towards the Daily 200 SMA / Weekly 50 SMA, perhaps even reaching the 97.09 Weekly High, but then reverses and continues the midterm bearish trend down, eventually taking out the last major Low at 91.88, continuing lower.