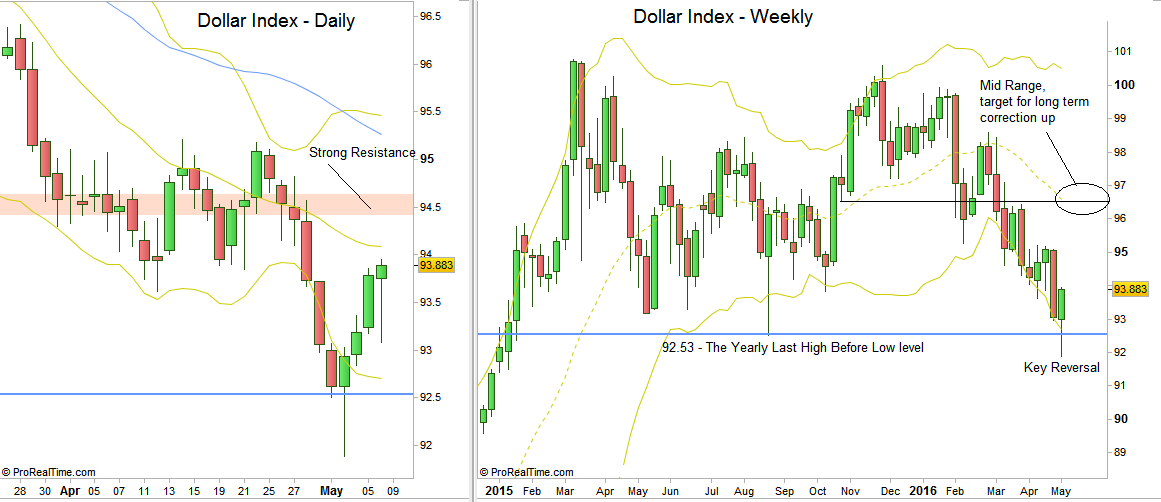

The US Dollar index managed to close last week strong, as a Bullish Key Reversal.

In the previous review, we emphasized the importance of the 92.53 level, which was the Yearly Last High Before Low, and this is the first time a Yearly bar is retracing towards it after it conquered that level last year, closing strongly above.

A reaction to that level should have been emerged, but currently the considerable penetration that eventually took place below that level last week, calls for more consolidation on the current levels.

So, despite the strong bullish key reversal, there are currently more chances to stay at the current levels of the last two week range, before possibly climbing back to the mid range at 96.6, rather than strong rally directly to the mid range. If this is truly the case, this behavior can last for couple of weeks, till the end of May, and even beyond.

Expect the levels of 94.42 till 94.66 to serve as a strong resistance as for the Daily, even Weekly terms.

I wouldn’t recommend counting on a Stop Loss below last week’s low as in case of the accumulation process described above, the price might be taking the Key Reversal’s Low before becoming bullish towards the end of such a process.

Dollar Index Daily and Weekly charts, at the courtesy of prorealtime.com

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.