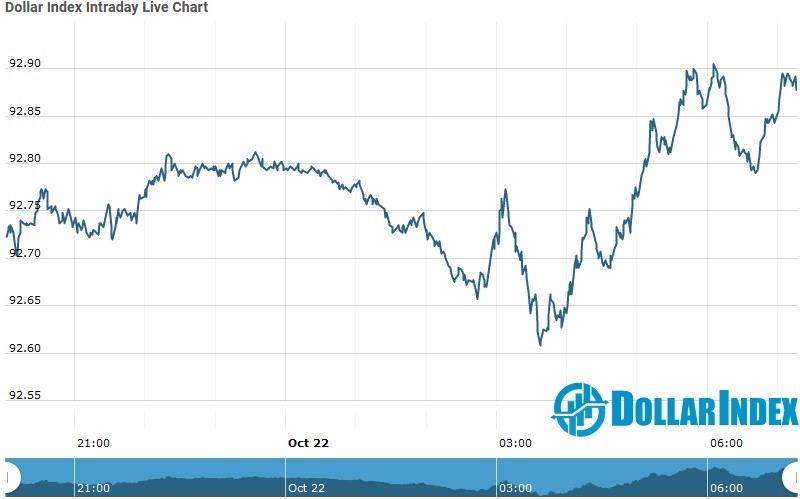

The U.S.Dollar Index is trading at 92.85 with a loss of –0.25% percent or –0.25% point.The Dow Futures is trading at 28,091.50 with a loss of -0.15% percent or -42.50 point. The S&P 500 Futures is trading at 3,425.12 with a loss of -0.22% percent or -7.38 point.The Nasdaq Futures is trading at 11,671.20 with a loss of -0.17% percent or -20.00 point.

TODAY’S FACTORS AND EVENTS

The dollar edged up from seven-week lows on Thursday as hopes for a fiscal package in the United States before the November elections crumbled again and the global surge in COVID-19 cases fuelled demand for safe-haven assets like the greenback.

Progress towards a U.S. stimulus deal has boosted sentiment in world markets and lifted demand for riskier assets in recent sessions — weighing this week on the dollar, which tends to weaken when risk appetite picks up.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 28,210.82 with a loss of –percent or ?97.97 point. The S&P 500 is trading at 3,435.56 with a loss of – percent or ?7.56 point. The Nasdaq Composite is trading at 11,484.69 with a loss of – percent or –31.80 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,603.78 with a loss of -0.86 percent or +13.93 point; the S&P 600 Small-Cap Index closed at 915.07 with a loss of percent or -4.18 point; the S&P 400 Mid-Cap Index closed at 1,970.13 with a loss of – percent or −14.13 point; the S&P 100 Index closed at 1,587.19 with a loss of – percent or −3.00 point; the Russell 3000 Index closed at 2,020.36 with a loss of –percent or −6.90 point; the Russell 1000 Index closed at 1,918.29 with a loss of –or −5.93 point