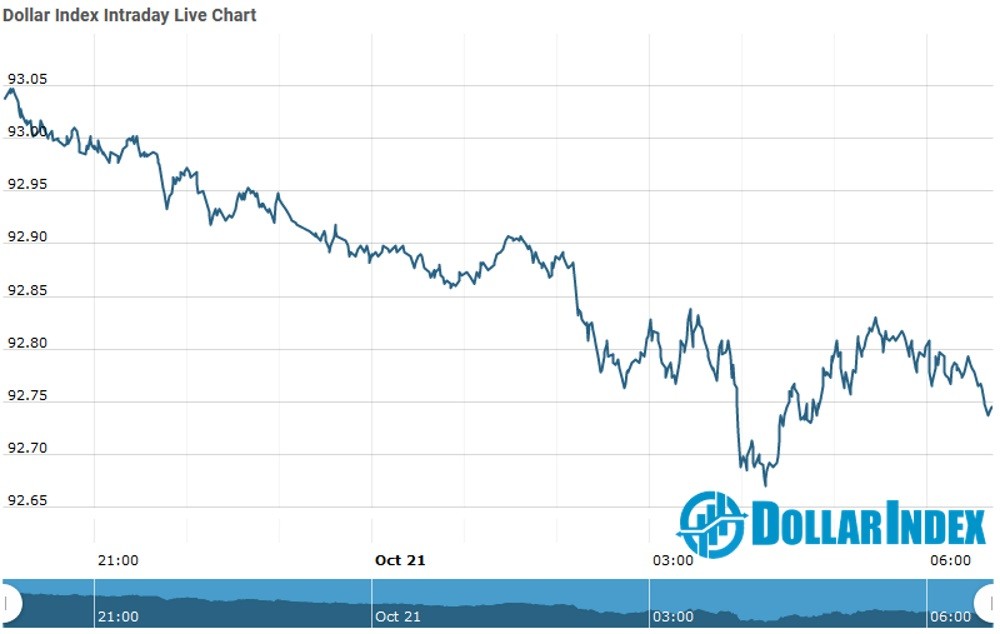

The U.S.Dollar Index is trading at 92.79 with a loss of -0.30% percent or -0.28 point.The Dow Futures is trading at 28,178.00 with a loss of -0.01% percent or -4.00 point. The S&P 500 Futures is trading at 3,435.38 up with +0.09% percent or +3.18 point.The Nasdaq Futures is trading at 11,679.90 up with +0.16% percent or +19.13 point.

TODAY’S FACTORS AND EVENTS

The U.S. dollar dipped on Tuesday, hitting a one-month low against a basket of major currencies, as investors awaited the outcome of fiscal stimulus talks ahead of the upcoming U.S. presidential election and coronavirus cases spiked in Europe.

The dollar index declined for a second day, with the safe-haven currency hitting 92.991, its lowest since Sept. 21, as House Speaker Nancy Pelosi she was optimistic Democrats could reach a deal with the Trump administration on additional COVID-19 relief that could get aid out by early next month.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 28,308.79 up with +percent or +113.37 point. The S&P 500 is trading at 3,443.12 with + percent or +16.20 point. The Nasdaq Composite is trading at 11,516.49 up with percent or +37.61 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,617.71 up with +0.25% percent or +4.08 point; the S&P 600 Small-Cap Index closed at 919.25 up with + percent or +6.16 point; the S&P 400 Mid-Cap Index closed at 1,984.26 up with + percent or +10.45 point; the S&P 100 Index closed at 1,590.19 with + percent or +7.87 point; the Russell 3000 Index closed at 2,027.26 with + percent or +7.75 point; the Russell 1000 Index closed at 1,924.22 up with +or +7.51 point