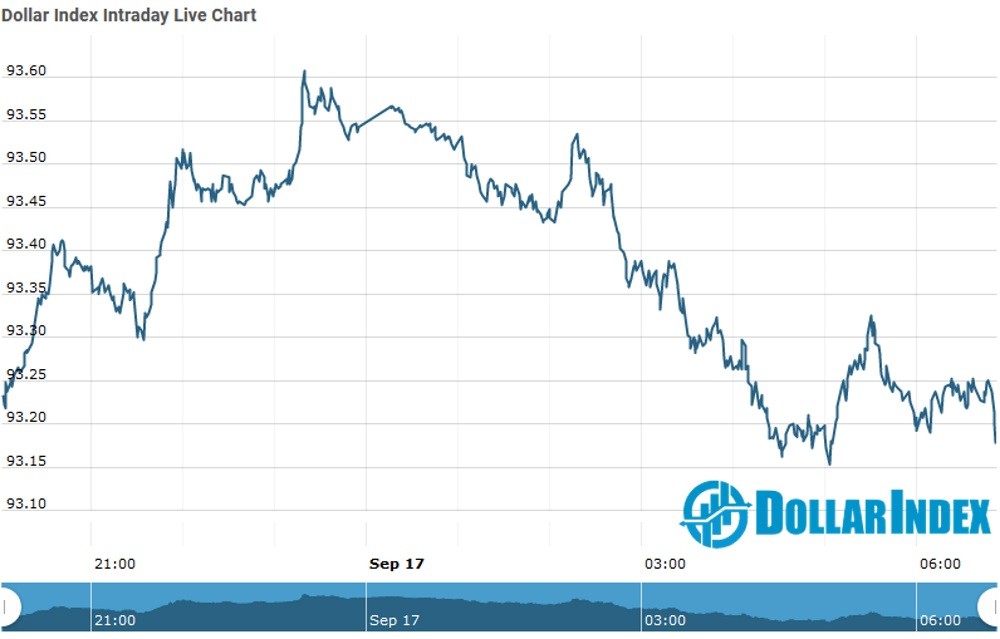

The U.S.Dollar Index is trading at 93.22 with 0.00% percent or 0.00 point.The Dow Futures is trading at 27,673.00 with a loss of -0.94% percent or -264.00 point. The S&P 500 Futures is trading at 3,343.38 with a loss of -1.07% percent or -36.02 point.The Nasdaq Futures is trading at 11,148.10 with a loss of -0.95% percent or -106.88 point.

TODAY’S FACTORS AND EVENTS

The Japanese yen inched higher on Wednesday as traders bet an ultra-accommodative U.S. Federal Reserve would weigh on the U.S. dollar, while the Chinese yuan extended gains one day after data pointed to better prospects for the world’s No. 2 economy.

The Fed is due to make its first policy statement since adopting a more tolerant approach to inflation later on Wednesday.

Traders bought yen on the belief the U.S. central bank may promise further stimulus, which would likely weaken the U.S. dollar and push Treasury yields lower. The Fed is not expected to move on rates but adjustments to bond purchases are possible.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 28,032.38 up with + percent or +36.78 point. The S&P 500 is trading at 3,385.49 with a loss of – percent or –15.71 point. The Nasdaq Composite is trading at 11,050.47 with a loss of percent or –139.86 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,552.33 up with 0.92% percent or +14.17 point; the S&P 600 Small-Cap Index closed at 882.78 with + percent or +6.04 point; the S&P 400 Mid-Cap Index closed at 1,898.55 up with + percent or +6.07 point; the S&P 100 Index closed at 1,563.88 with a loss of – percent or −13.03 point; the Russell 3000 Index closed at 1,981.53 with a loss of percent or −6.89 point; the Russell 1000 Index closed at 1,882.91 with a loss of –or −7.96 point.