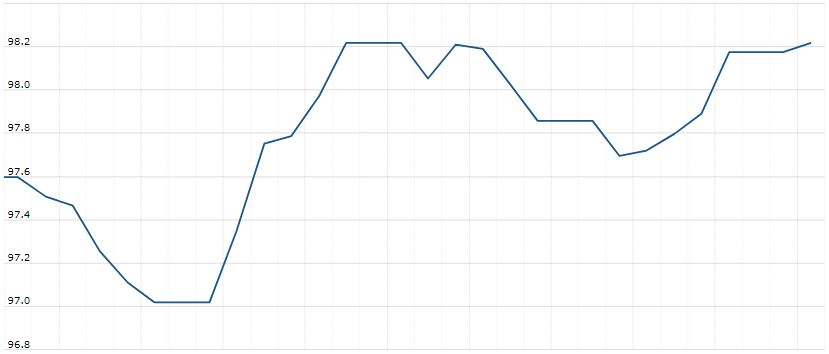

The U.S. Dollar Index is trading at 98.34 up with +0.09% percent or +0.08 point. The Dow Futures is trading at 28,159.50 up with +0.10% percent or +29.50 point. The S&P 500 Futures is trading at 3,149.38 up with +0.18% percent or +5.63 point. The Nasdaq Futures is trading at 8,425.00 up with +0.29% percent or +24.25 point.

TODAY’S FACTORS AND EVENTS

The dollar pushed higher on Wednesday and flirted with the $1.10 level against the euro, boosted by yet more talk of a deal to resolve the U.S.-China trade dispute.

The greenback, which this week has risen in line with the more positive tone in trade negotiations, also increased versus the yen towards three-week highs.

Wednesday sees little new data releases in the euro zone but a clutch of revisions in the United States ahead of Thursday’s Thanksgiving holiday.

“Everything all told, the U.S. data is more likely to support the dollar, so that EUR-USD might well drop below the $1.10 mark again today,” Commerzbank analysts said in a note

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 28,121.68 up with +0.20% percent or +55.21 point. The S&P 500 is trading at 3,140.52 up with +0.22% percent or +6.88 point. The Nasdaq Composite is trading at 8,647.93 up with +0.18% percent or +15.44 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,624.23 up with +0.14% percent or +2.33 point; the S&P 600 Small-Cap Index closed at 995.57 with a loss of –0.029% percent or -0.29 point; the S&P 400 Mid-Cap Index closed at 2,018.02 up with +0.41% percent or +8.32 point; the S&P 100 Index closed at 1,397.76 up with +0.20% percent or +2.76 point; the Russell 3000 Index closed at 1,842.18 up with +0.23% percent or +4.27 point; the Russell 1000 Index closed at 1,737.00 up with +0.24% or +4.13 point.