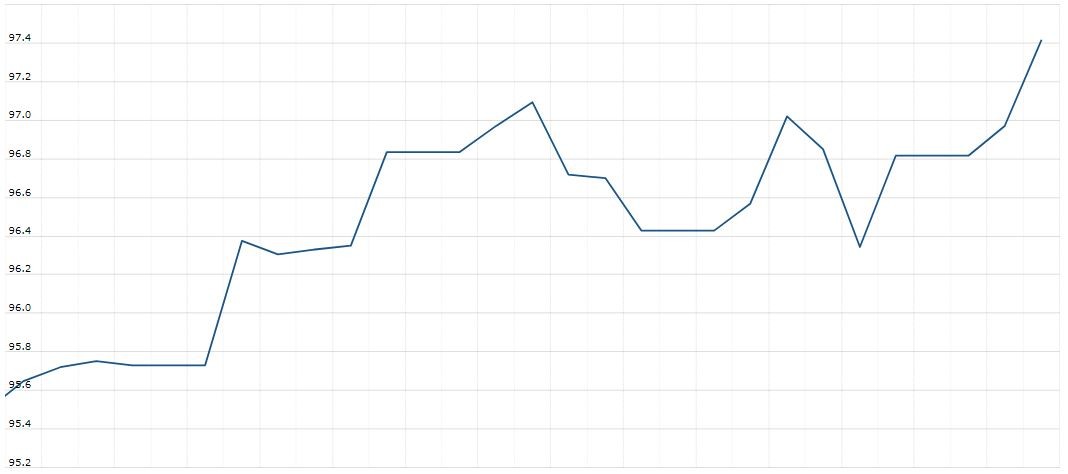

The U.S. Dollar Index is trading at 97.66 with a loss of -0.04% percent or -0.04 point. The Dow Futures is trading at 27,274.50 with a loss of -0.18% percent or -49.50 point. The S&P 500 Futures is trading at 3,000.38 with a loss of -0.25% percent or -7.62 point. The Nasdaq Futures is trading at 7,944.38 with a loss of -0.49% percent or -38.75 point.

TODAY’S FACTORS AND EVENTS

The euro fell to a two-month low against the dollar on Wednesday, hit by weak economic data and speculation that the European Central Bank may start easing policy as soon as this week.

Money markets are pricing in a 45% chance of a 10 basis point cut on Thursday. The ECB could also signal further reductions the road or a fresh round of quantitative easing, said Esther Maria Reichelt, an analyst at Commerzbank.

“It won’t be just about the (possible) rate cut,” she said.

Euro overnight implied volatility gauges rose to their highest since mid-December at 11.6 vol, while the common currency weakened by 0.2% to $1.1127, the lowest since May 30.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 27,171.90 up with +0.065% percent or +17.70 point. The S&P 500 is trading at 2,985.03 up with +0.28% percent or +8.42 point. The Nasdaq Composite is trading at 8,204.14 up with +0.71% percent or +57.65 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,554.96 up with +0.66% percent or +10.18 point; the S&P 600 Small-Cap Index closed at 1,554.96 up with +0.92% percent or +8.67 point; the S&P 400 Mid-Cap Index closed at 1,956.20 up with +1.06% percent or +20.56 point; the S&P 100 Index closed at 1,328.49 up with +0.63% percent or +8.37 point; the Russell 3000 Index closed at 1,765.61 up with +0.68% percent or +11.96 point; the Russell 1000 Index closed at 1,664.94 up with +0.68% or +11.30 point.