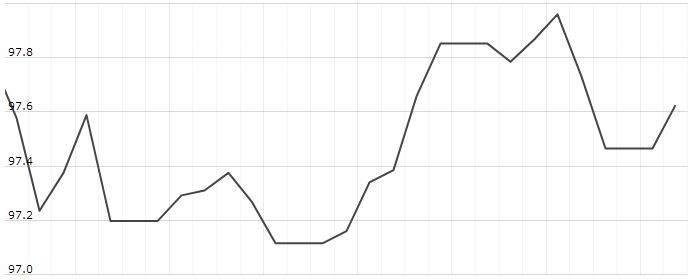

The U.S. Dollar Index is trading at 98.12 with a loss of -0.03% percent or -0.02 point. The Dow Futures is trading at 25,190.50 up with +0.32% percent or +81.50 point. The S&P 500 Futures is trading at 2,791.88 up with +0.43% percent or +11.88 point. The Nasdaq Futures is trading at 7,248.88 up with +0.46% percent or +32.88 point.

TODAY’S FACTORS AND EVENTS

The dollar edged toward a one-week high on Thursday as the trade tensions between China and the United States prompted investors to seek shelter in the greenback.

While U.S. money markets are pricing in roughly two rate cuts by January 2020 and the bond yield curve inverted further overnight, signalling rising recessionary risks for the world’s biggest economy, demand for dollars show no signs of abating.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 25,126.41 with a loss of -0.87% percent or -221.36 point. The S&P 500 is trading at 2,783.02 with a loss of -0.69% percent or -19.37 point. The Nasdaq Composite is trading at 7,547.31 with a loss of -0.79% percent or -60.04 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,489.95 with a loss of -0.94% percent or -14.07 point; the S&P 600 Small-Cap Index closed at 904.09 with a loss of -0.84% percent or -7.70 point; the S&P 400 Mid-Cap Index closed at 1,832.77 with a loss of -0.62% percent or -11.40 point; the S&P 100 Index closed at 1,231.97 with a loss of -0.73% percent or -9.02 point; the Russell 3000 Index closed at 1,638.06 with a loss of -0.71% percent or -11.69 point; the Russell 1000 Index closed at 1,541.07 with a loss of -0.69% or -10.73 point.