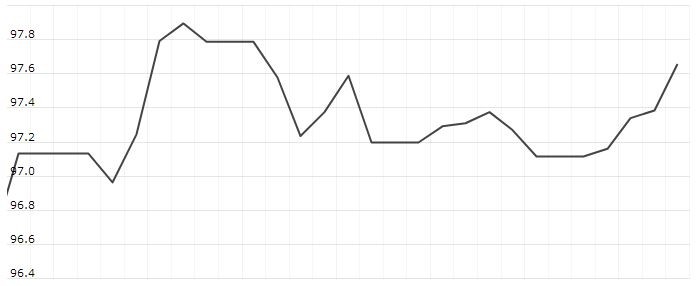

The U.S. Dollar Index is trading at 97.88 up with +0.03% percent or +0.03 point. The Dow Futures is trading at 25,746.00 with a loss of -0.47% percent or -121.00 point. The S&P 500 Futures is trading at 2,864.62 with a loss of -0.48% percent or -13.88 point. The Nasdaq Futures is trading at 7,552.50 with a loss of -0.63% percent or -47.75 point.

TODAY’S FACTORS AND EVENTS

The Japanese yen strengthened on Friday, attracting safe-haven buying due to lingering concerns among investors about trade tensions and impending European Parliament elections.

Currency moves in response to recent U.S.-Chinese trade hostilities have been fairly muted but traders have bid up the yen, considered a safe haven in times of stress because of Japan’s status as the world’s largest creditor.

“Despite yesterday’s rebound, we are still reluctant to trust a long-lasting reversal in risk appetite. With the U.S. (verbally) attacking China, and China willing to respond, we cannot assume that the worst is behind us,”

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 25,862.68 up with +0.84% percent or +214.66 point. The S&P 500 is trading at 2,876.32 up with +0.89% percent or +25.36 point. The Nasdaq Composite is trading at 7,898.05 up with +0.97% percent or +75.90 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,557.24 up with +0.58% percent or +8.97 point; the S&P 600 Small-Cap Index closed at 949.34 up with +0.35% percent or +3.28 point; the S&P 400 Mid-Cap Index closed at 1,911.41 up with +0.60% percent or +11.43 point; the S&P 100 Index closed at 1,274.32 up with +0.95% percent or +12.02 point; the Russell 3000 Index closed at 1,695.60 up with +0.87% percent or +14.70 point; the Russell 1000 Index closed at 1,594.05 up with +0.90% or +14.17 point.